Housing Application Form Page 4

Download a blank fillable Housing Application Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Housing Application Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

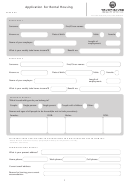

Part B – Income and assets details

6

Household income details

Please provide evidence of the gross weekly income (before tax) for all household members aged 18

years and over. Attach documents to confirm income received over the past three months as follows:

Wages: payslips for thirteen (13) consecutive weeks or a letter from your employer confirming gross (before

tax) income.

Government pension, benefit or allowance (including Family Tax Benefit Part A): a statement no more

than two weeks old, showing pension, benefit, allowance received from Centrelink, Veterans Affairs or other

agencies.

Self-employed: provide previous financial year’s tax notice of assessment from the Australian Taxation Office.

Please discuss this with a Territory Housing Officer if your business has been operating for less than 12 months.

Income from any other source (e.g. Workers Compensation): a letter or statement of other documentation

that confirms both the source of income and the gross (before tax) amount.

Note: if you are claiming child maintenance payments as exempt income you will need to provide proof of

your payments (such as pay slips, confirmation from the Child Support Agency, or Statutory Declarations

from both parties).

7

Statement of assets

Please provide a statement of assets of all household members aged 18 years and over. Attach

documentary evidence of those assets and any loans against them. If any of these assets cannot be

accessed (such as superannuation) you will need to provide supporting documentary evidence.

Normal household goods (furniture, white goods, TV etc.), personal items (clothing etc.) and one family

vehicle are not counted as assessable assets. Assessable assets include high priced saleable items,

financial investments and cash savings.

All bank accounts

Account holder’s name

Bank and branch

Account number

Amount ($)

Fixed term deposits

Account holder’s name

Bank and branch

Account number

Amount ($)

Shares investments (include accessible superannuation funds)

Account holder’s name

Name of shares/funds

Current value ($)

Motor vehicle

Owner’s name

Make and model

Estimated current value ($)

Amount owed ($)

Property and land / mobile home / boat / caravan / any other valuable saleable items

Owner’s name

Description of assets

Estimated current value ($)

Amount owed ($)

If you require additional space, please write on another piece of paper and attach to this form.

4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8