PAGE 2 OF 2

MV-82TON (11/07)

Certificates of Title are available only for the following:.

N

1973 and newer model year vehicles (including salvage vehicles).

N

1973 and newer model year trailers with an unladen weight of 1,000 lis. or more.

N

1987 and newer model year non-documented boats that are at least 14 feet long and equipped with a motor.

N

1995 and newer model year manufactured homes that are at least 8 feet wide or 40 feet long when being transported, or at least 320 square feet when erected on a site.

THIS IS WHAT YOU NEED TO APPLY FOR A CERTIFICATE OF TITLE

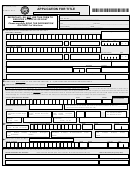

1. APPLICATION (FORM MV-82TON) - Complete Sections A and B on page 1 of the application and sign the OWNER CERTIFICATION section

on page 2. If the vehicle or boat was sold by a NYS-registered dealer, the dealer must sign the DEALER CERTIFICATION section on page 2.

2. PROOF OF OWNERSHIP - If purchased new, the proof of ownership is a Manufacturer’s Statement or Certificate of Origin. If purchased used, the

proof of ownership is usually a certificate of title (or a transferable registration and bill of sale if from a state that does not require a title). For vehicles

sold by a New York State dealer, a Certificate of Sale (Form MV-50) is also required. For boats sold by a dealer, a bill of sale from the dealer must

accompany the proof of ownership. If you have other proof of ownership, please contact the Title Bureau to find out if we can accept it.

3. PROOF OF NAME AND DATE OF BIRTH - Only proofs of name that contain the owner’s signature will be accepted. For example: a copy of a photo

driver license, a military photo ID card, or a credit card. Proof of date of birth is a copy of a photo driver license, a birth certificate, or military separation

papers (DD-214). A corporation must provide proof of incorporation.

4. SALES TAX CLEARANCE - Proof that you paid or are exempt from paying sales tax is needed. The following are acceptable proofs of sales tax clearance:

N

Form MV-50 (Certificate of Sale) - for vehicles purchased from a New York State-registered dealer.

N

Form FS-6T (Sales Tax Clearance Receipt) - for vehicles and boats purchased from an out-of-state dealer, or through a sale that does not involve a

dealer. Form FS-6T may be obtained at any Motor Vehicles office by paying sales tax or by showing that you are tax exempt.

N

A bill of sale - for boats purchased from a New York State-registered boat dealer. The bill of sale must indicate that tax was paid, or that the

purchaser is exempt from sales tax.

N

Signed Manufactured Home Dealer Certification - for manufactured homes purchased from a dealer authorized to collect New York State and local

sales tax. The Manufactured Home Dealer Certification below must be completed by the dealer. PLEASE NOTE: Sales tax clearance is only

required for manufactured homes purchased as NEW.

5. FILING LIENS - Section C on page 1 can only be used by a NYS-registered dealer to file a new lien. All other liens must be recorded by the

lender sending a Notice of Lien (MV-900) and $5 lien fee OR an MV-900.1 (if you have an account with the Department of Motor Vehicles). To be

sure the lien is recorded before the title is issued, the lender should send the Notice of Lien with this application, OR as soon as possible after the loan

is made. For further information, obtain our pamphlet “What Lenders Should Know About the NYS Vehicle and Boat Title Program” (Form MV-909)

by contacting the Motor Vehicles Title Bureau, or by visiting our website ( ) under DMV Forms and Publications.

6. TITLE/LIEN FEE - The fee for a title for all vehicles and boats is $50. The fee for a Certificate of Title for a manufactured home is $125. The fee for

filing a lien is $5. Payment must be made by check or money order payable to “Commissioner of Motor Vehicles”. PLEASE NOTE: We can only

accept payment of the lien fee from a dealer or lienholder. The lien fee cannot be paid by the owner.

7. Bring your completed application to any DMV office, or mail to the address below, with:

N

N

N

N

proof of ownership

title application fee

proof of name and date of birth

notice of lien and lien fee (if applicable)

N

sales tax clearance (if applicable)

N

proof of Power of Attorney (if applicable)

Mailing Address: Title Bureau, Department of Motor Vehicles, 6 Empire State Plaza, Albany, NY 12228

N

N

N

N

8. The following applications must be mailed to Title Bureau:

Garageman Liens

Salvage Certificates

Manufactured Homes

Boats

N

Bonded Vehicles

N

Application by Dealer/Manufacturers for vehicles returned by purchaser under Lemon Law

PLEASE COMPLETE AND SIGN ALL SECTIONS THAT APPLY

OWNER CERTIFICATION: I state that the information I have given is true to the best of my knowledge. If the vehicle is currently registered in another

name, I authorize such registration.

±

(

)

Sign Name in Full

Date

Daytime Telephone Number (optional)

Print Name in Full

±

(

)

Sign Name in Full

Date

Daytime Telephone Number (optional)

Print Name in Full

±

If signing for a corporation, print your name and title

NYS REGISTERED DEALER CERTIFICATION: I certify that all information on this application is true. I take responsibility

for the integrity of the papers delivered to the Motor Vehicles Title Bureau.

±

(

)

Signature of Dealer or Authorized Representative

Date

Telephone Number

±

Print your name and title

MANUFACTURED HOME DEALER CERTIFICATION: I certify that all New York State and local taxes due as a result of this

sale, if any, have been collected from the purchaser.

±

(

)

Signature of Dealer or Authorized Representative

Date

Telephone Number

NYS Sales Tax Number

RESET/CLEAR

1

1 2

2