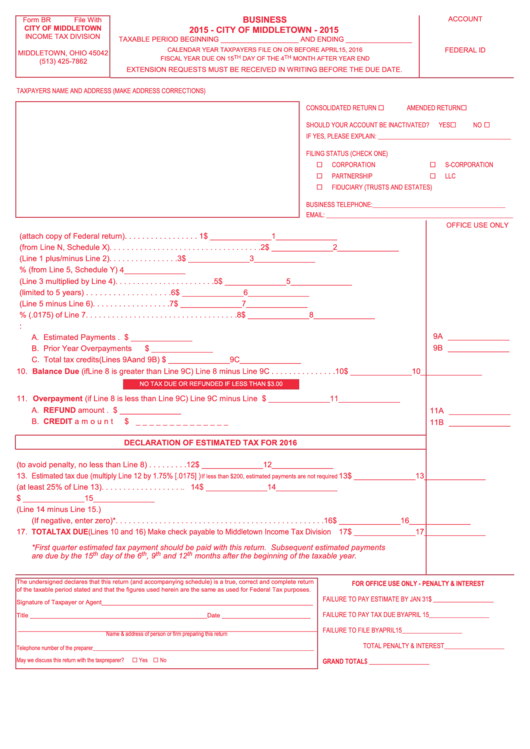

Form Br - Business - City Of Middletown - 2015

ADVERTISEMENT

BUSINESS

ACCOUNT

Form BR

File With

CITY OF MIDDLETOWN

2015 - CITY OF MIDDLETOWN - 2015

INCOME TAX DIVISION

TAXABLE PERIOD BEGINNING ____________________ AND ENDING _________________

P.O. BOX 428739

FEDERAL ID

CALENDAR YEAR TAXPAYERS FILE ON OR BEFORE APRIL 15, 2016

MIDDLETOWN, OHIO 45042

TH

TH

FISCAL YEAR DUE ON 15

DAY OF THE 4

MONTH AFTER YEAR END

(513) 425-7862

EXTENSION REQUESTS MUST BE RECEIVED IN WRITING BEFORE THE DUE DATE.

TAXPAYERS NAME AND ADDRESS (MAKE ADDRESS CORRECTIONS)

CONSOLIDATED RETURN

AMENDED RETURN

SHOULD YOUR ACCOUNT BE INACTIVATED?

YES

NO

IF YES, PLEASE EXPLAIN: __________________________________________

FILING STATUS (CHECK ONE)

CORPORATION

S-CORPORATION

PARTNERSHIP

LLC

FIDUCIARY (TRUSTS AND ESTATES)

BUSINESS TELEPHONE:

__________________________________________

EMAIL: ___________________________________________________________

OFFICE USE ONLY

1. Adjusted Federal Taxable Income (attach copy of Federal return) . . . . . . . . . . . . . . . . .

1 $ ______________

1 ______________

2. Adjustments (from Line N, Schedule X)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 $ ______________

2 ______________

3. Taxable income before apportionment (Line 1 plus/minus Line 2) . . . . . . . . . . . . . . . .

3 $ ______________

3 ______________

4. Apportionment percentage _________% (from Line 5, Schedule Y)

4 ______________

5. Middletown taxable income (Line 3 multiplied by Line 4) . . . . . . . . . . . . . . . . . . . . . . .

5 $ ______________

5 ______________

6. Net loss carryforward (limited to 5 years)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6 $ ______________

6 ______________

7. Income subject to Middletown income tax (Line 5 minus Line 6) . . . . . . . . . . . . . . . . . .

7 $ ______________

7 ______________

8. Middletown tax is 1.75% (.0175) of Line 7. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8 $ ______________

8 ______________

9. Tax credits:

9A ______________

A. Estimated Payments

. . . . . . . . . . . . . . . . . . . . . . . . . . . . 9A $ ______________

9B ______________

B. Prior Year Overpayments

. . . . . . . . . . . . . . . . . . . . . . . . 9B $ ______________

C. Total tax credits (Lines 9A and 9B) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9C $ ______________

9C ______________

10. Balance Due (if Line 8 is greater than Line 9C) Line 8 minus Line 9C . . . . . . . . . . . . . . .10 $ ______________

10 ______________

NO TAX DUE OR REFUNDED IF LESS THAN $3.00

11. Overpayment (if Line 8 is less than Line 9C) Line 9C minus Line 8. . . . . . . . . . . . . . . . 11 $ ______________

11 ______________

A. REFUND amount

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11A $ ______________

11A ______________

B. CREDIT amount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11B $ ______________

11B ______________

DECLARATION OF ESTIMATED TAX FOR 2016

12. Total estimated income subject to tax (to avoid penalty, no less than Line 8) . . . . . . . . . 12 $ ______________

12 ______________

13. Estimated tax due (multiply Line 12 by 1.75% [.0175] )

13 $ ______________

13 ______________

If less than $200, estimated payments are not required

14. First quarter tax due before credits (at least 25% of Line 13) . . . . . . . . . . . . . . . . . . .

14 $ ______________

14 ______________

.

15. Prior year tax credit from Line 11B above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15 $ ______________

15 ______________

16. Net estimated first quarter tax due with this return (Line 14 minus Line 15.)

(If negative, enter zero)*. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16 $ ______________

16 ______________

17. TOTAL TAX DUE (Lines 10 and 16) Make check payable to Middletown Income Tax Division 17 $ ______________

17 ______________

*First quarter estimated tax payment should be paid with this return. Subsequent estimated payments

th

th

th

th

are due by the 15

day of the 6

, 9

and 12

months after the beginning of the taxable year.

The undersigned declares that this return (and accompanying schedule) is a true, correct and complete return

FOR OFFICE USE ONLY - PENALTY & INTEREST

of the taxable period stated and that the figures used herein are the same as used for Federal Tax purposes.

FAILURE TO PAY ESTIMATE BY JAN 31

$ ___________________

Signature of Taxpayer or Agent ______________________________________________________________

FAILURE TO PAY TAX DUE BY APRIL 15

___________________

Title ____________________________________________________ Date __________________________

________________________________________________________________________________________

FAILURE TO FILE BY APRIL 15

___________________

Name & address of person or firm preparing this return

TOTAL PENALTY & INTEREST ___________________

Telephone number of the preparer _______________________________________________________________________________

May we discuss this return with the taxpreparer?

Yes No

GRAND TOTAL

$ ___________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2