Form 51a151 - Enterprise Zone Sales And Use Tax Exemption Certificate Form For Qualified Businesses Machinery And Equipment

ADVERTISEMENT

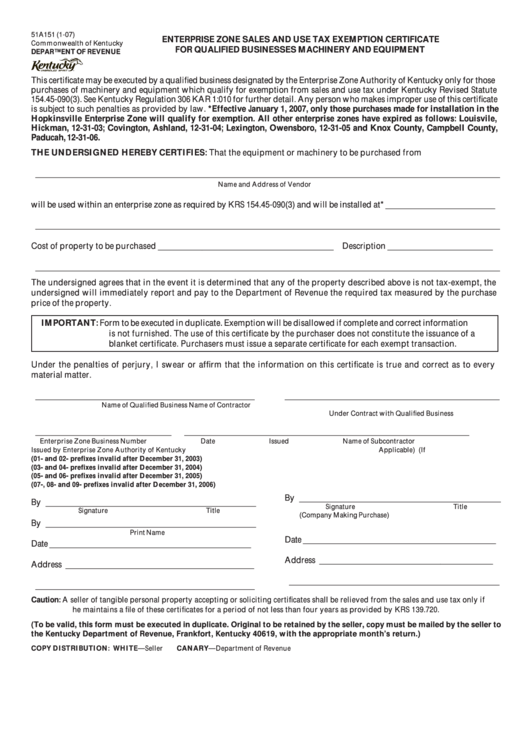

51A151 (1-07)

ENTERPRISE ZONE SALES AND USE TAX EXEMPTION CERTIFICATE

Commonwealth of Kentucky

FOR QUALIFIED BUSINESSES MACHINERY AND EQUIPMENT

DEPARTMENT OF REVENUE

This certificate may be executed by a qualified business designated by the Enterprise Zone Authority of Kentucky only for those

purchases of machinery and equipment which qualify for exemption from sales and use tax under Kentucky Revised Statute

154.45-090(3). See Kentucky Regulation 306 KAR 1:010 for further detail. Any person who makes improper use of this certificate

is subject to such penalties as provided by law. *Effective January 1, 2007, only those purchases made for installation in the

Hopkinsville Enterprise Zone will qualify for exemption. All other enterprise zones have expired as follows: Louisvile,

Hickman, 12-31-03; Covington, Ashland, 12-31-04; Lexington, Owensboro, 12-31-05 and Knox County, Campbell County,

Paducah, 12-31-06.

THE UNDERSIGNED HEREBY CERTIFIES: That the equipment or machinery to be purchased from

__________________________________________________________________________________________________________

Name and Address of Vendor

will be used within an enterprise zone as required by KRS 154.45-090(3) and will be installed at* _________________________

__________________________________________________________________________________________________________

Cost of property to be purchased ________________________________________ Description ________________________

__________________________________________________________________________________________________________

The undersigned agrees that in the event it is determined that any of the property described above is not tax-exempt, the

undersigned will immediately report and pay to the Department of Revenue the required tax measured by the purchase

price of the property.

IMPORTANT:

Form to be executed in duplicate. Exemption will be disallowed if complete and correct information

is not furnished. The use of this certificate by the purchaser does not constitute the issuance of a

blanket certificate. Purchasers must issue a separate certificate for each exempt transaction.

Under the penalties of perjury, I swear or affirm that the information on this certificate is true and correct as to every

material matter.

__________________________________________________

_________________________________________________

Name of Qualified Business

Name of Contractor

Under Contract with Qualified Business

_______________________________

________________

_________________________________________________

Enterprise Zone Business Number

Date Issued

Name of Subcontractor

Issued by Enterprise Zone Authority of Kentucky

(If

Applicable)

(01- and 02- prefixes invalid after December 31, 2003)

(03- and 04- prefixes invalid after December 31, 2004)

(05- and 06- prefixes invalid after December 31, 2005)

(07-, 08- and 09- prefixes invalid after December 31, 2006)

By ______________________________________________

By ________________________________________________

Signature

Title

Signature

Title

(Company Making Purchase)

By ________________________________________________

Print Name

Date ____________________________________________

Date ______________________________________________

Address _________________________________________

Address ___________________________________________

________________________________________________

__________________________________________________

Caution:

A seller of tangible personal property accepting or soliciting certificates shall be relieved from the sales and use tax only if

he maintains a file of these certificates for a period of not less than four years as provided by KRS 139.720.

(To be valid, this form must be executed in duplicate. Original to be retained by the seller, copy must be mailed by the seller to

the Kentucky Department of Revenue, Frankfort, Kentucky 40619, with the appropriate month’s return.)

COPY DISTRIBUTION: WHITE—Seller

CANARY—Department of Revenue

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1