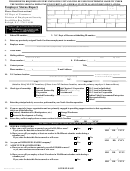

Form 1d - Domestic Employment Status Report (2001) Page 2

ADVERTISEMENT

DWS-U1

Form 1D

Rev. 5/01

INSTRUCTIONS

The Utah Employment Security Act provides that the Department of Workforce Services must determine the status of each

business and each person independently established in a trade, occupation, or profession. This report is to be completed immediately

and returned to P.O. Box 45288, Salt Lake City, Utah 84145-0288.

All items must be completed. If an item does not apply to your business, enter N/A (Not Applicable).

Except as indicated below, all items are self-explanatory:

ITEM 2: If you have more than one trade name or business name, also list the name or names by which your company is

best known by the public.

ITEM 7: Address of agent or office able to provide wage data, weeks of employment and other information about employees

separated from your employment, if different from item 2.

ITEM 8: If there is more than one permanent work site, please attach a separate sheet listing the name, address and telephone

number of each site.

ITEM 11: Please describe your primary domestic activity, whether you are a private household employing domestic help, child

care services, in-home nursing services; a fraternity or sorority or some other type of domestic activity.

ITEM 12: The definition of wages is currently defined by Section 3306(b), of the Internal Revenue Code of 1986, with modifications, sub-

tractions, and adjustments provided in Section 35A-4-208 Subsections (2), (3), and (4), of the Utah Employment Security Act with regard

to how the wage base is determined. Wages means all remuneration for employment including commissions, bonuses, salaries or

draws to corporate officers, tips and the cash value of all remuneration in any medium other than cash.

Wages in Item 12 refers only to wages for employment covered by the Employment Security Act. Under the Act wages paid for

services performed by a sole proprietor’s spouse, parents or children under the age of 21 are not wages for unemployment. Wages

paid to the entity owner (i.e. sole proprietor, partners and LLC members) are not wages for unemployment.

ITEM 13: If you acquired (in whole or part) the business activity previously conducted by another entity, or if the business entity has

changed (for example, from a proprietorship to a corporation, even if the owners are still principally the same) please complete

Items 13-13e. “Acquired” means to have obtained the use of the business or assets through any legal means. It is not necessary to

purchase the assets in order to have acquired them, nor is it necessary for your predecessor to have actually owned the business or

assets for you to have acquired the business or assets from him. An acquisition can include change in the form of ownership, inheritance,

repossession, foreclosure, gift, sale or lease.

ITEM 14: A domestic employer is subject if, during any calendar quarter in the current or preceding calendar year, you paid cash

remuneration of $1,000 or more. In completing item 14, please provide only the amount of cash remuneration and not the value of non

cash remuneration such as meals and lodging provided by you, the employer. (The non cash remuneration may be deemed a wage when

filing Employer’s Quarterly Contribution Report, but is not considered when calculating whether you as an employer have reached $1,000

in a calendar quarter.)

If additional information is needed, please call 801-526-9400 or 1-800-222-2857 ext. 9400 (Instate toll free number).

Fax 801-526-9377.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2