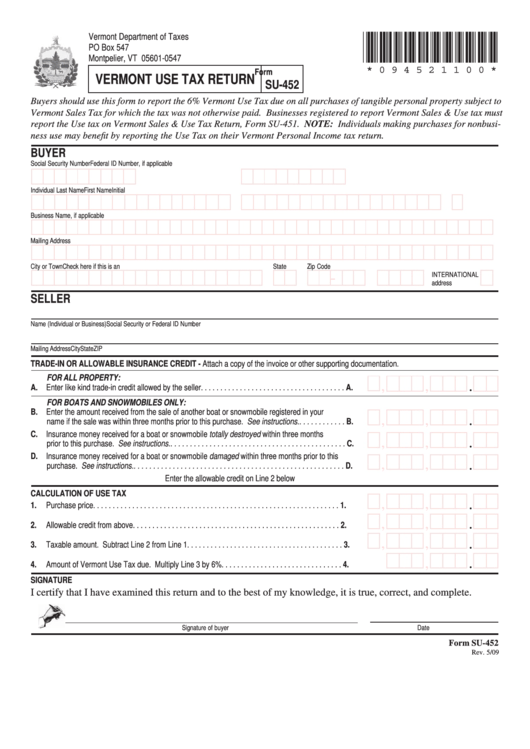

Form Su-452 - Vermont Use Tax Return - Vt Department Of Taxes - 2009

ADVERTISEMENT

*094521100*

Vermont Department of Taxes

PO Box 547

Montpelier, VT 05601-0547

* 0 9 4 5 2 1 1 0 0 *

Form

VERMONT USE TAX RETURN

SU-452

Buyers should use this form to report the 6% Vermont Use Tax due on all purchases of tangible personal property subject to

Vermont Sales Tax for which the tax was not otherwise paid. Businesses registered to report Vermont Sales & Use tax must

report the Use tax on Vermont Sales & Use Tax Return, Form SU-451. NOTE: Individuals making purchases for nonbusi-

ness use may benefit by reporting the Use Tax on their Vermont Personal Income tax return.

BUYER

Social Security Number

Federal ID Number, if applicable

Individual Last Name

First Name

Initial

Business Name, if applicable

Mailing Address

City or Town

State

Zip Code

Check here if this is an

-

INTERNATIONAL

address

SELLER

Name (Individual or Business)

Social Security or Federal ID Number

Mailing Address

City

State

ZIP

TRADE-IN OR ALLOWABLE INSURANCE CREDIT - Attach a copy of the invoice or other supporting documentation.

FOR ALL PROPERTY:

,

,

.

A. Enter like kind trade-in credit allowed by the seller . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . A.

FOR BOATS AND SNOWMOBILES ONLY:

B. Enter the amount received from the sale of another boat or snowmobile registered in your

,

,

.

name if the sale was within three months prior to this purchase. See instructions. . . . . . . . . . . . . B.

C. Insurance money received for a boat or snowmobile totally destroyed within three months

,

,

.

prior to this purchase. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . C.

D. Insurance money received for a boat or snowmobile damaged within three months prior to this

,

,

.

purchase. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . D.

Enter the allowable credit on Line 2 below

CALCULATION OF USE TAX

,

,

.

1.

Purchase price . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.

,

,

.

2.

Allowable credit from above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.

,

,

.

3.

Taxable amount. Subtract Line 2 from Line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.

,

.

4.

Amount of Vermont Use Tax due. Multiply Line 3 by 6% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.

SIGNATURE

I certify that I have examined this return and to the best of my knowledge, it is true, correct, and complete.

Signature of buyer

Date

Form SU-452

Rev. 5/09

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2