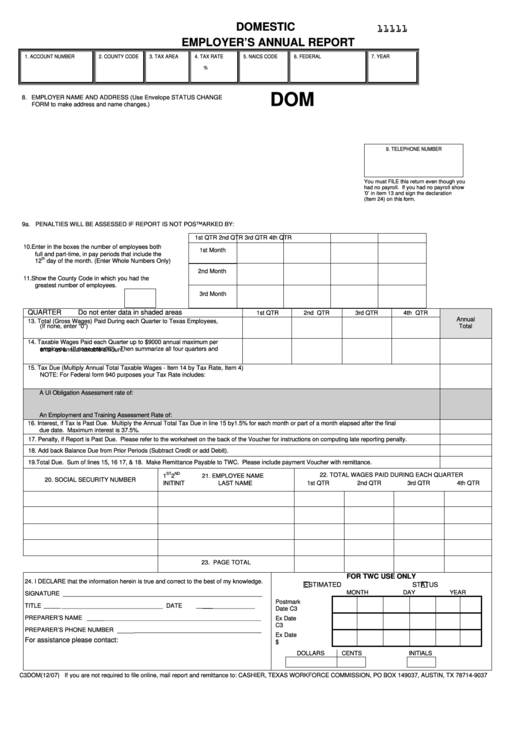

DOMESTIC

11111

EMPLOYER’S ANNUAL REPORT

1. ACCOUNT NUMBER

2. COUNTY CODE

3. TAX AREA

4. TAX RATE

5. NAICS CODE

6. FEDERAL I.D. NUMBER

7. YEAR

%

DOM

8. EMPLOYER NAME AND ADDRESS (Use Envelope STATUS CHANGE

FORM to make address and name changes.)

9. TELEPHONE NUMBER

You must FILE this return even though you

had no payroll. If you had no payroll show

‘0’ in item 13 and sign the declaration

(Item 24) on this form.

9a. PENALTIES WILL BE ASSESSED IF REPORT IS NOT POSTMARKED BY:

1st QTR

2nd QTR

3rd QTR

4th QTR

10. Enter in the boxes the number of employees both

1st Month

full and part-time, in pay periods that include the

th

12

day of the month. (Enter Whole Numbers Only)

2nd Month

11. Show the County Code in which you had the

greatest number of employees.

3rd Month

QUARTER

Do not enter data in shaded areas

1st QTR

2nd QTR

3rd QTR

4th QTR

Annual

13. Total (Gross Wages) Paid During each Quarter to Texas Employees,

Total

(If none, enter “0”)

14. Taxable Wages Paid each Quarter up to $9000 annual maximum per

employee. (If none enter “0”). Then summarize all four quarters and

enter as annual taxable amount.

15. Tax Due (Multiply Annual Total Taxable Wages - Item 14 by Tax Rate, Item 4)

NOTE: For Federal form 940 purposes your Tax Rate includes:

A UI Obligation Assessment rate of:

An Employment and Training Assessment Rate of:

16. Interest, if Tax is Past Due. Multiply the Annual Total Tax Due in line 15 by 1.5% for each month or part of a month elapsed after the final

due date. Maximum interest is 37.5%.

17. Penalty, if Report is Past Due. Please refer to the worksheet on the back of the Voucher for instructions on computing late reporting penalty.

18. Add back Balance Due from Prior Periods (Subtract Credit or add Debit).

19. Total Due. Sum of lines 15, 16 17, & 18. Make Remittance Payable to TWC. Please include payment Voucher with remittance.

ST

ND

22. TOTAL WAGES PAID DURING EACH QUARTER

1

2

21. EMPLOYEE NAME

20. SOCIAL SECURITY NUMBER

1st QTR

2nd QTR

3rd QTR

4th QTR

INIT INIT

LAST NAME

23. PAGE TOTAL

FOR TWC USE ONLY

24. I DECLARE that the information herein is true and correct to the best of my knowledge.

ESTIMATED

STATUS

MONTH

DAY

YEAR

SIGNATURE _____________________________________________________________

Postmark

TITLE

_______________________________

DATE

________________

Date C3

PREPARER’S NAME

________________________________________________

Ex Date

C3

PREPARER’S PHONE NUMBER

_______________________________________

Ex Date

For assistance please contact:

$

DOLLARS

CENTS

INITIALS

C3DOM(12/07) If you are not required to file online, mail report and remittance to: CASHIER, TEXAS WORKFORCE COMMISSION, PO BOX 149037, AUSTIN, TX 78714-9037

1

1 2

2