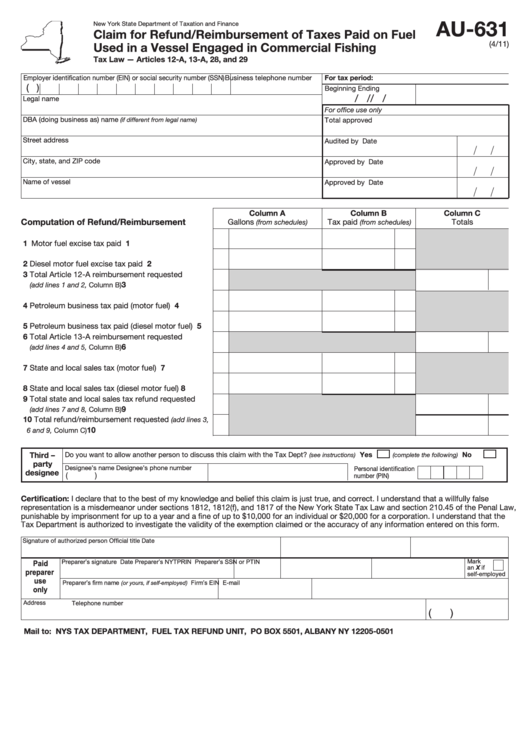

Form Au-631 - Claim For Refund/reimbursement Of Taxes Paid On Fuel Used In A Vessel Engaged In Commercial Fishing

ADVERTISEMENT

AU‑631

New York State Department of Taxation and Finance

Claim for Refund/Reimbursement of Taxes Paid on Fuel

(4/11)

Used in a Vessel Engaged in Commercial Fishing

Tax Law — Articles 12‑A, 13‑A, 28, and 29

For tax period:

Employer identification number (EIN) or social security number (SSN)

Business telephone number

(

)

Beginning

Ending

/

/

/

/

Legal name

For office use only

DBA (doing business as) name

(if different from legal name)

Total approved

Street address

Audited by

Date

City, state, and ZIP code

Approved by

Date

Name of vessel

Approved by

Date

Column A

Column B

Column C

Computation of Refund/Reimbursement

Gallons

Tax paid

Totals

(from schedules)

(from schedules)

1 Motor fuel excise tax paid ......................................

1

2 Diesel motor fuel excise tax paid ...........................

2

3 Total Article 12‑A reimbursement requested

.................................

3

(add lines 1 and 2, Column B)

4 Petroleum business tax paid (motor fuel) ...............

4

5 Petroleum business tax paid (diesel motor fuel) ....

5

6 Total Article 13‑A reimbursement requested

.................................

6

(add lines 4 and 5, Column B)

7 State and local sales tax (motor fuel) .....................

7

8 State and local sales tax (diesel motor fuel)...........

8

9 Total state and local sales tax refund requested

.................................

9

(add lines 7 and 8, Column B)

10 Total refund/reimbursement requested

(add lines 3,

................................................

10

6 and 9, Column C)

Third –

Do you want to allow another person to discuss this claim with the Tax Dept?

Yes

No

(see instructions)

(complete the following)

party

Designee’s name

Designee’s phone number

Personal identification

designee

(

)

number (PIN)

Certification: I declare that to the best of my knowledge and belief this claim is just true, and correct. I understand that a willfully false

representation is a misdemeanor under sections 1812, 1812(f), and 1817 of the New York State Tax Law and section 210.45 of the Penal Law,

punishable by imprisonment for up to a year and a fine of up to $10,000 for an individual or $20,000 for a corporation. I understand that the

Tax Department is authorized to investigate the validity of the exemption claimed or the accuracy of any information entered on this form.

Signature of authorized person

Official title

Date

Preparer’s signature

Date

Preparer’s NYTPRIN

Preparer’s SSN or PTIN

Mark

Paid

an X if

preparer

self-employed

use

Preparer’s firm name

Firm’s EIN

E-mail

(or yours, if self-employed)

only

Address

Telephone number

(

)

Mail to: NYS TAX DEPARTMENT, FUEL TAX REFUND UNIT, PO BOX 5501, ALBANY NY 12205‑0501

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3