A

D

R

LABAMA

EPARTMENT OF

EVENUE

S

U

T

D

ALES AND

SE

AX

IVISION

A

S

DMINISTRATION

ECTION

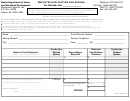

Filing The Proper Petition

There are two types of petitions – Joint Petitions and Direct Petitions. The Joint Petition requires the sig-

natures of both parties to a transaction. The Direct Petition requires the signature of only one party to a

transaction. No refunds will be issued unless the proper petition is filed. Listed below are the taxes

administered by the Sales and Use Tax Division and the proper petition to file for each.

Type of Tax

Petition Form Required

Signatures Required

State, City, or County Sales Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . Joint* . . . . . . . . . . . . . . . . . . . Seller and Purchaser

State, City, or County Sellers Use Tax. . . . . . . . . . . . . . . . . . . . . . Joint* . . . . . . . . . . . . . . . . . . . Seller and Purchaser

Lodgings Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Joint* . . . . . . . . . . . . . . . . . . . Seller and Purchaser

Utility Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Joint* . . . . . . . . . . . . . . . . . . . Seller and Purchaser

Cellular Services Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Joint* . . . . . . . . . . . . . . . . . . . Seller and Purchaser

Contractors Gross Receipts Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . Direct . . . . . . . . . . . . . . . . . . Contractor

Direct Pay Permits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Direct . . . . . . . . . . . . . . . . . . Permit Holder

State, City, or County Consumers Use Tax . . . . . . . . . . . . . . . . Direct . . . . . . . . . . . . . . . . . . Consumer-Purchaser

Rental or Leasing Tax. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Direct . . . . . . . . . . . . . . . . . . Lessor

Nursing Facility Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Direct . . . . . . . . . . . . . . . . . . Care Provider

Pharmaceutical Provider Tax. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Direct . . . . . . . . . . . . . . . . . . Provider

*A direct petition may be filed if the seller has not collected the tax from the purchaser or if the seller has refunded or

credited the tax to the purchaser. Seller must document these facts.

Required Signatures

The petition must bear the signature of the party involved. If a petitioner is an individual the individual must sign.

If a petitioner is a partnership or limited liability partnership, a partner must sign. If a petitioner is a corporation, an

officer of the corporation must sign. If a petitioner is a limited liability company, a member must sign. If a petitioner

is a representative of the taxpayer, the Alabama Department of Revenue’s official Power of Attorney (POA) form is

required.

Documentation

Your petition must be documented. The petitioner should attach invoices, receipts, check copies, accrual records,

copies of returns, and other documentation to the petition sufficient to provide an audit trail. If invoice copies are

not attached then a schedule of the invoices providing invoice date, invoice number, invoice amount, and a descrip-

tion of the merchandise should be attached.

Mail Completed Petition To:

Alabama Department of Revenue

Sales and Use Tax Division – Refund Section

P.O. Box 327710

Montgomery, AL 36132-7710

Telephone: (334) 242-1490

Fax: (334) 353-9330

Page 2 of 2

1

1 2

2