Buy/sell Agreement Template

ADVERTISEMENT

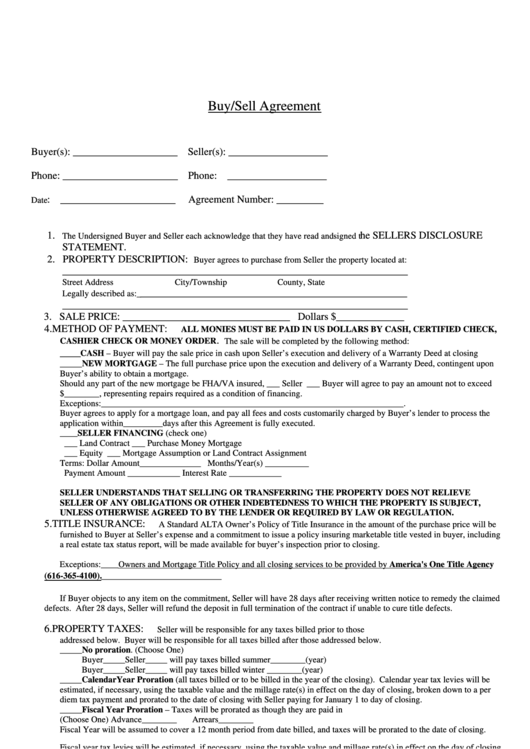

Buy/Sell Agreement

Buyer(s): ____________________

Seller(s): ___________________

Phone: ______________________

Phone: ___________________

: ______________________

Agreement Number: _________

Date

1.

he SELLERS DISCLOSURE

The Undersigned Buyer and Seller each acknowledge that they have read and signed t

STATEMENT.

2. PROPERTY DESCRIPTION:

Buyer agrees to purchase from Seller the property located at:

__________________________________________________________________

Street Address

City/Township

County, State

___________________________________________________

Legally described as:_

__________________________________________________________________

3. SALE PRICE: ________________________________ Dollars $_____________

4. METHOD OF PAYMENT:

ALL MONIES MUST BE PAID IN US DOLLARS BY CASH, CERTIFIED CHECK,

.

The sale will be completed by the following method:

CASHIER CHECK OR MONEY ORDER

____

CASH – Buyer will pay the sale price in cash upon Seller’s execution and delivery of a Warranty Deed at closing

_____NEW MORTGAGE – The full purchase price upon the execution and delivery of a Warranty Deed, contingent upon

Buyer’s ability to obtain a mortgage.

Should any part of the new mortgage be FHA/VA insured, ___ Seller ___ Buyer will agree to pay an amount not to exceed

$________, representing repairs required as a condition of financing.

Exceptions:_____________________________________________________________________.

Buyer agrees to apply for a mortgage loan, and pay all fees and costs customarily charged by Buyer’s lender to process the

application within_________days after this Agreement is fully executed.

____SELLER FINANCING (check one)

___ Land Contract

___ Purchase Money Mortgage

___ Equity

___ Mortgage Assumption or Land Contract Assignment

Terms:

Dollar Amount______________ Months/Year(s) __________

Payment Amount ____________

Interest Rate ____________

SELLER UNDERSTANDS THAT SELLING OR TRANSFERRING THE PROPERTY DOES NOT RELIEVE

SELLER OF ANY OBLIGATIONS OR OTHER INDEBTEDNESS TO WHICH THE PROPERTY IS SUBJECT,

UNLESS OTHERWISE AGREED TO BY THE LENDER OR REQUIRED BY LAW OR REGULATION.

5. TITLE INSURANCE:

A Standard ALTA Owner’s Policy of Title Insurance in the amount of the purchase price will be

furnished to Buyer at Seller’s expense and a commitment to issue a policy insuring marketable title vested in buyer, including

a real estate tax status report, will be made available for buyer’s inspection prior to closing.

Exceptions:____Owners and Mortgage Title Policy and all closing services to be provided by America's One Title Agency

_______________________

(616-365-4100).

If Buyer objects to any item on the commitment, Seller will have 28 days after receiving written notice to remedy the claimed

defects. After 28 days, Seller will refund the deposit in full termination of the contract if unable to cure title defects.

6. PROPERTY TAXES:

Seller will be responsible for any taxes billed prior to those

addressed below. Buyer will be responsible for all taxes billed after those addressed below.

_____No proration. (Choose One)

Buyer_____Seller_____ will pay taxes billed summer________(year)

Buyer_____Seller_____ will pay taxes billed winter ________(year)

_____Calendar Year Proration (all taxes billed or to be billed in the year of the closing). Calendar year tax levies will be

estimated, if necessary, using the taxable value and the millage rate(s) in effect on the day of closing, broken down to a per

diem tax payment and prorated to the date of closing with Seller paying for January 1 to day of closing.

_____Fiscal Year Proration – Taxes will be prorated as though they are paid in

(Choose One)

Advance________

Arrears________

Fiscal Year will be assumed to cover a 12 month period from date billed, and taxes will be prorated to the date of closing.

Fiscal year tax levies will be estimated, if necessary, using the taxable value and millage rate(s) in effect on the day of closing,

broken down to a per diem tax payment and prorated to the date of closing with Seller paying to day of closing.

Exceptions:______________________________________________________________________

7. ASSESSMENTS:

(Choose One)

____

Seller will pay any existing assessments which are due and payable, or a lien or both, on the property on or before the

date first written above.

____

Buyer will assume or pay any assessment balance which remains after Seller pays for any assessment installments

which are due and payable on or before the date first written above.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3