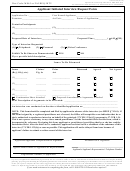

Form Cl-0822-0614 Certified Loan Request Page 2

ADVERTISEMENT

INSTRUCTIONS

CL-0822-0614

Use this form only when a member cannot submit a pension loan request using MBOS because:

1.) The member has been on leave of absence without pay or transferred employers within the

last six months;

2.) The member is paid by State supplemental payroll; or

3.) The employer is late submitting the Quarterly Report of Contributions.

Do not submit this request for any other reason, as it will be returned.

All other pension loan requests MUST be submitted using MBOS. For more information about MBOS visit the

Division of Pensions and Benefits Web site at:

PART 1 — MEMBER INFORMATION AND LOAN REQUEST

The member must complete items 1 through 6. We suggest the loan check be mailed to the member’s home

address instead of work. Loan checks must be mailed and cannot be picked up at the Division of Pensions and

Benefits.

The member must indicate the loan amount: No loan may be less than $50 and increase in multiples of $10. The

loan amount may not exceed 50 percent of the member’s total contributions and the loan balance may not exceed

$50,000. If the amount of the loan requested, when added to any existing loan balance, exceeds $50,000, the mem-

ber will be issued a check for the difference between the loan balance and $50,000, when added to the highest bal-

ance due (without interest) in a prior 12 month period for all loans (please see IRS Regulations).

The member should request a repayment schedule: Loans have a maximum repayment schedule of five

years. Members may specify whether they wish to have the minimum payment, have the loan paid off by a specific

date, or pay more than the minimum deduction. If a box is not selected, the loan repayment schedule is set to the

minimum payment for no more than a five-year period. (The minimum repayment must be equal to or greater than

the member’s monthly or, for State employees, biweekly base salary multiplied by the current full rate of pension con-

tributions).

Members with large existing loan balances who take a new loan will likely see the loan deduction increase if the

loan cannot be repaid within the five-year maximum when paid at the normal minimum deduction.

The member must sign the request. Prior to signing, please be sure the member reads and understands the Loan

Provisions and IRS Requirements included with this request form. Incomplete and unsigned requests will not be

processed.

IMPORTANT NOTICE: If a member is not satisfied with a loan amount or repayment schedule when the check

is received, the loan may be canceled by returning the original uncashed loan check. If a loan check is

returned, the funds are deposited back into the pension account and will be available with the next quarterly

posting.

BY CASHING THE LOAN CHECK THE MEMBER IS AGREEING

TO THE LOAN AMOUNT AND THE REPAYMENT SCHEDULE

PART 2 — EMPLOYER CERTIFICATION

The employer must complete the Certification portion of the request.

Indicate the reason why the Certified Loan Request is being submitted. Complete the items for current salary, and

the additional return to payroll and/or transfer information as appropriate.

The employer must sign the Certified Loan Request. Mail the completed request to the Loan Section, Division of

Pensions and Benefits, PO Box 295, Trenton, NJ 08625-0295, or fax the completed request to (609) 292-3613.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4