Form Fh-0703-1215 - Employee Tax Certification For Civil(Union Partner Or Domestic Partner Benefit

ADVERTISEMENT

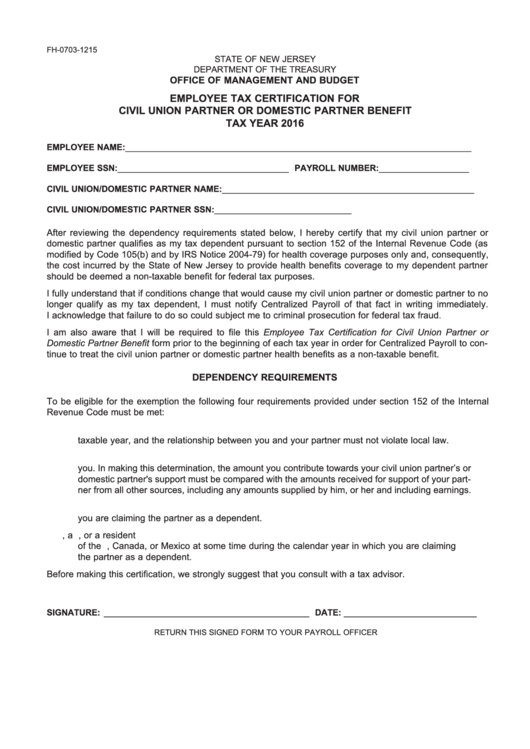

FH-0703-1215

STATE OF NEW JERSEY

DEPARTMENT OF THE TREASURY

OFFICE OF MANAGEMENT AND BUDGET

EMPLOYEE TAX CERTIFICATION FOR

CIVIL UNION PARTNER OR DOMESTIC PARTNER BENEFIT

TAX YEAR 2016

EMPLOYEE NAME: _________________________________________________________________________________

EMPLOYEE SSN: ________________________________________ PAYROLL NUMBER: _____________________

CIVIL UNION/DOMESTIC PARTNER NAME: ___________________________________________________________

CIVIL UNION/DOMESTIC PARTNER SSN: ________________________________

After reviewing the dependency requirements stated below, I hereby certify that my civil union partner or

domestic partner qualifies as my tax dependent pursuant to section 152 of the Internal Revenue Code (as

modified by Code 105(b) and by IRS Notice 2004-79) for health coverage purposes only and, consequently,

the cost incurred by the State of New Jersey to provide health benefits coverage to my dependent partner

should be deemed a non-taxable benefit for federal tax purposes.

I fully understand that if conditions change that would cause my civil union partner or domestic partner to no

longer qualify as my tax dependent, I must notify Centralized Payroll of that fact in writing immediately.

I acknowledge that failure to do so could subject me to criminal prosecution for federal tax fraud.

I am also aware that I will be required to file this Employee Tax Certification for Civil Union Partner or

Domestic Partner Benefit form prior to the beginning of each tax year in order for Centralized Payroll to con-

tinue to treat the civil union partner or domestic partner health benefits as a non-taxable benefit.

DEPENDENCY REQUIREMENTS

To be eligible for the exemption the following four requirements provided under section 152 of the Internal

Revenue Code must be met:

1. Your civil union partner or domestic partner must be a member of your household during the entire

taxable year, and the relationship between you and your partner must not violate local law.

2. Your civil union partner or domestic partner must receive more than half of his or her support from

you. In making this determination, the amount you contribute towards your civil union partner’s or

domestic partner's support must be compared with the amounts received for support of your part-

ner from all other sources, including any amounts supplied by him, or her and including earnings.

3. Your civil union partner or domestic partner must not file a joint tax return for the tax year in which

you are claiming the partner as a dependent.

4. Your civil union partner or domestic partner must be a U.S. citizen, a U.S. national, or a resident

of the U.S., Canada, or Mexico at some time during the calendar year in which you are claiming

the partner as a dependent.

Before making this certification, we strongly suggest that you consult with a tax advisor.

SIGNATURE: ________________________________________________ DATE: _______________________________

RETURN THIS SIGNED FORM TO YOUR PAYROLL OFFICER

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1