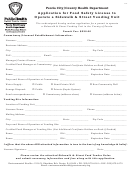

Application For License To Operate A Food And Lodging Establishment Form Page 2

ADVERTISEMENT

APPLICANT'S STATEMENT REGARDING CHILD SUPPORT AND TAXES

You must answer questions 1 and 2.

Regarding Child Support

Title 15 § 795 requires that: A professional license or other authority to conduct a trade or business may not be issued or

renewed unless the person certifies that he or she is in good standing with respect to or in full compliance with a plan to

pay any and all child support payable under a support order as of the date the application is filed. "Good standing" means

that less than one-twelfth of the annual support obligation is overdue; or liability for any support payable is being

contested in a judicial or quasi-judicial proceeding; or he or she is in compliance with a repayment plan approved by the

office of child support or agreed to by the parties; or the licensing authority determines that immediate payment of support

would impose an unreasonable hardship. (15 V.S.A. § 795)

1.

You must check one of the two statements below regarding child support regardless whether or

not you have children:

I hereby certify that, as of the date of this application: (a) I am not subject to any support order or (b) I am

subject to a support order and I am in good standing with respect to it, or (c) I am subject to a support order

and I am in full compliance with a plan to pay any and all child support due under that order.

or

I hereby certify that I am NOT in good standing with respect to child support dues as of the date of this

application and I hereby request that the licensing authority determine that immediate payment of child

support would impose an unreasonable hardship. Please forward an "Application for Hardship".

Regarding Taxes

Title 32 § 3113 requires that: A professional license or other authority to conduct a trade or business shall not be issued or

renewed unless the person certifies that he or she is in good standing with the Department of Taxes. "Good standing"

means that no taxes are due and payable and all returns have been filed, the tax liability is on appeal, the taxpayer is in

compliance with a payment plan approved by the Commissioner of Taxes, or the licensing authority determines that

immediate payment of taxes would impose an unreasonable hardship. (32 V.S.A. § 3113)

2.

You must check one of the two statements below regarding taxes:

I hereby certify, under the pains and penalties or perjury, that I am in good standing with respect to or in full

compliance with a plan to pay any and all taxes due to the State of Vermont as of the date of this application.

(The maximum penalty for perjury is fifteen years in prison, a $10,000.00 fine or both).

or

I hereby certify that I am NOT in good standing with respect to taxes due to the State of Vermont as of the

date of this application and I hereby request that the licensing authority determine that immediate payment of

taxes would impose an unreasonable hardship. Please forward an "Application for Hardship".

Tax ID Number: __________________ OR

Social Security #*

/

/

Date of Birth

/

/_____

* The disclosure of your social security number is mandatory, it is solicited by the authority granted by 42 U.S.C. § 405

(c)(2)(C), and will be used by the Department of Taxes and the Department of Employment and Training in the

administration of Vermont tax laws, to identify individuals affected by such laws, and by the Office of Child Support.

STATEMENT OF APPLICANT

I certify that the information stated by me in this application is true and accurate to the best of my knowledge and that I

understand providing false information or omission of information is unlawful and may jeopardize my

license/certification/registration status.

Printed Name:_________________________________________________________ Date:_______________________

Signature of Applicant: ___________________________________________________ Title:_______________________

7/2013

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2