Ptax-760 Form - Reassessment Request Due To Construction Of Improvements - Henry County Assessment Office

ADVERTISEMENT

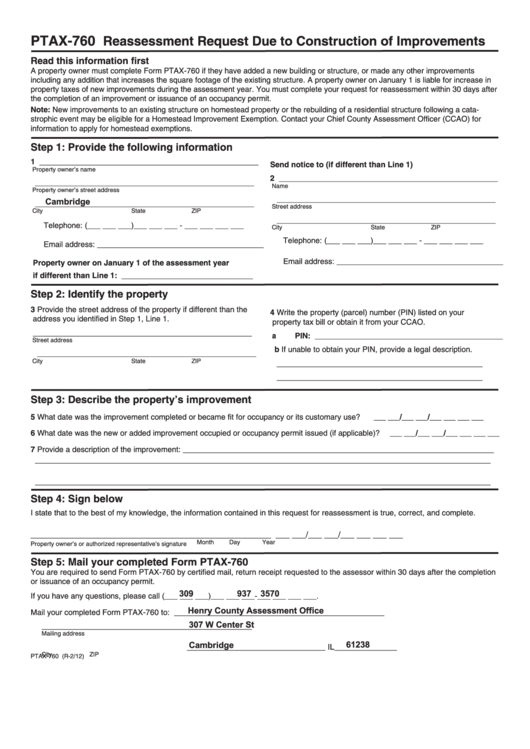

PTAX-760

Reassessment Request Due to Construction of Improvements

Read this information first

A property owner must complete Form PTAX-760 if they have added a new building or structure, or made any other improvements

including any addition that increases the square footage of the existing structure. A property owner on January 1 is liable for increase in

property taxes of new improvements during the assessment year. You must complete your request for reassessment within 30 days after

the completion of an improvement or issuance of an occupancy permit.

Note: New improvements to an existing structure on homestead property or the rebuilding of a residential structure following a cata-

strophic event may be eligible for a Homestead Improvement Exemption. Contact your Chief County Assessment Officer (CCAO) for

information to apply for homestead exemptions.

Step 1: Provide the following information

1

__________________________________________________

Send notice to (if different than Line 1)

Property owner’s name

2

__________________________________________________

__________________________________________________

Name

Property owner’s street address

__________________________________________________

Cambridge

__________________________________________________

Street address

City

State

ZIP

__________________________________________________

Telephone: (___ ___ ___)___ ___ ___ - ___ ___ ___ ___

City

State

ZIP

Telephone: (___ ___ ___)___ ___ ___ - ___ ___ ___ ___

Email address: ______________________________________

Email address: ______________________________________

Property owner on January 1 of the assessment year

if different than Line 1: ______________________________

Step 2: Identify the property

3

Provide the street address of the property if different than the

4

Write the property (parcel) number (PIN) listed on your

address you identified in Step 1, Line 1.

property tax bill or obtain it from your CCAO.

__________________________________________________

a

PIN: _______________________________________

Street address

b If unable to obtain your PIN, provide a legal description.

__________________________________________________

City

State

ZIP

_______________________________________________

_______________________________________________

Step 3: Describe the property’s improvement

5

What date was the improvement completed or became fit for occupancy or its customary use? ___ ___/___ ___/___ ___ ___ ___

6

What date was the new or added improvement occupied or occupancy permit issued (if applicable)? ___ ___/___ ___/___ ___ ___ ___

7

Provide a description of the improvement: _______________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

Step 4: Sign below

I state that to the best of my knowledge, the information contained in this request for reassessment is true, correct, and complete.

____________________________________________________

___ ___/___ ___/___ ___ ___ ___

Month

Day

Year

Property owner’s or authorized representative’s signature

Step 5: Mail your completed Form PTAX-760

You are required to send Form PTAX-760 by certified mail, return receipt requested to the assessor within 30 days after the completion

or issuance of an occupancy permit.

309

937

3570

If you have any questions, please call (___ ___ ___)___ ___ ___-___ ___ ___ ___.

Henry County Assessment Office

Mail your completed Form PTAX-760 to:

________________________________________________

307 W Center St

________________________________________________

Mailing address

Cambridge

61238

_______________________________ IL______________

City

ZIP

PTAX-760 (R-2/12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1