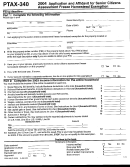

Form PTAX-766 Instructions

What is the IRC 501(c)(2), (c)(8), or (c)(10)

b Proof of exempt status under IRC Section 501(c)(2), (c)(8), or

Fraternal Organization Assessment Freeze?

(c)(10) such as

The Internal Revenue Code (IRC) Section 501(c)(2), (c)(8), or

• an IRS group exemption letter to an organization, plus a

(c)(10) fraternal organization assessment freeze, enacted under

copy of an annual IRS filing by that organization, that lists

35 ILCS 200/10-360, allows any qualified fraternal organization or

your organization covered by the exemption letter; or

its affiliated Illinois not-for-profit corporation chartered prior to

• Your U.S. Form 990; or

1920 to elect to freeze the assessed value (AV) of the real

• Your IRS determination letter in response to your filing of

property it owns and uses. The AV is frozen by the chief county

U.S. Form 1024.

assessment officer (CCAO) at 15 percent of tax year 2002 AV for

property that qualifies in tax year 2003, or 15 percent of the AV

c Proof of ownership or other legal or equitable interest in the

for property for the tax year the property first qualifies after tax

property, such as

year 2003.

• a deed; or

Any improvements or additions made to the property that in-

• a contract for deed; or

crease the AV of the property also are frozen at 15 percent of the

• a trust document; or

AV of the improvement or addition in the year first assessed.

• a title insurance policy; or

• an organizational agreement; or

Who qualifies for the assessment freeze?

• an incorporation document; or

To qualify, a fraternal organization or its affiliated Illinois not-for-

• a court order; or

profit corporation chartered prior to 1920 must

• an affidavit of adverse possession.

• own and use real property,

d Copies of leases or contracts concerning the property, if

• be an exempt entity under IRC Section 501(c)(2), (c)(8), or

applicable.

(c)(10), and

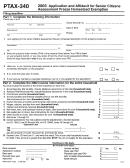

When should I file Form PTAX-766?

• consist of members who provide, directly or indirectly,

For all counties but Cook County: You must file Form PTAX-766,

financial support for charitable works, such as medical care,

with your CCAO by December 31 of the assessment year for which

drug rehabilitation, or education.

you are applying.

How do I apply for the assessment freeze for the

For Cook County: You must file Form PTAX-766, with the Cook

first time?

County Assessor by January 31 of the assessment year for which

you are applying.

The fraternal organization’s chief presiding officer should complete

and sign Form PTAX-766, to apply for this assessment freeze. You

What if I need additional assistance?

must have the form notarized and attach supporting documenta-

If you need additional assistance, please contact your CCAO,

tion. See “What do I need to attach to Form PTAX-766?”.

whose address and phone number are shown below.

How do I renew the assessment freeze?

Where do I mail my completed Form PTAX-766?

If you are renewing this assessment freeze and have no

Mail your completed Form PTAX-766 to:

changes to report for this assessment year, the chief presiding

officer only needs to complete Step 1, sign this form, and have it

notarized before filing it with the CCAO.

MADISON

_____________________________________ County CCAO

If you are renewing this assessment freeze and have changes to

report for this assessment year, the chief presiding officer must

157 N MAIN ST, SUITE 229

_________________________________________________

complete Step 1, any lines in Step 2 that have changed, sign this

Mailing address

form, and have it notarized before filing it with the CCAO. In

62025

_____________________________________ IL _________

Edwardsville

addition, you must attach documentation explaining any changes.

City

ZIP

Some examples of changes you should report include

If you have any questions, please call:

• additions or improvements,

• change in name of fraternal organization,

618 692-6270

(

_____________________

)

—

• conveyance of property,

• destruction or removal of improvements,

• leasing of property.

What do I need to attach to Form PTAX-766?

Your fraternal organization must attach copies of the following to

Form PTAX-766.

a Proof of an Illinois not-for-profit corporation charter prior to

1920 —

• your fraternal organization’s Illinois charter issued prior to

1920; or

• a certification that your fraternal organization was char-

tered in Illinois prior to 1920; or

• a certification that your fraternal organization was affiliated

with a qualified fraternal organization that was chartered in

Illinois prior to 1920.

PTAX-766 (N-1/03)

Reset

Print

1

1 2

2