CIGARETTE AND ROLL-YOUR-OWN TOBACCO REPORTING INSTRUCTIONS:

As part of the Master Settlement Agreement (MSA) between cigarette manufacturers and the state of Missouri, the Missouri Department of Revenue is required to compile informa-

tion about cigarettes and roll-your-own tobacco purchased for sale in Missouri. Missouri’s participation in the MSA mandated legislation requires manufacturers who are not

signatories to the MSA to pay into an escrow account a sum roughly equivalent to that which is paid by the participating manufacturers. This legislation also requires the Missouri

Department of Revenue to gather information concerning purchases of cigarettes and roll-your-own tobacco that is manufactured/imported by non-participating manufacturers. This

information will be provided to the Missouri Attorney General for use in administering the MSA agreement.

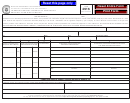

Alternate Reports:

You may elect to design your own reports utilizing your own software or database. Alternate forms are permissible with the department’s approval as long as all the required infor-

mation is provided and in the same format as the wholesalers monthly report of cigarettes and roll-your-own tobacco.

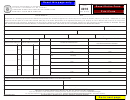

Heading:

Complete the calendar month and year covered by this report. Business name, address, telephone number, license number, and contact person are required.

Column A:

Enter the number of individual cigarettes purchased for sale in Missouri. List only cigarettes contained in packages to which you will affix the Missouri excise tax stamp. Do not list

cigarettes that were purchased with the Missouri stamp already affixed.

Column B:

Report in ounces the quantity of roll-your-own tobacco purchased for sale to a retailer or consumer in Missouri for each brand listed in Column C.

Column C:

Enter the full brand name of the product (do not abbreviate). Do not break down into sub-categories, such as regular, menthol, light, etc. For example, for a cigarette named “Alpha

Gold Menthol Lights,” report only “Alpha Gold”. Do not report as “A B Gold” or “A B Gold Menthol Lights”.

Column D:

List the complete name and address, including street, city, and state, of the manufacturer, non-participating manufacturer, or subsequent-participating manufacturer you purchased

cigarettes or roll-your-own tobacco products from as listed in Column A or B.

Column E:

List the complete name and address, including street, city, and state of the supplier you purchased cigarettes or roll-your-own tobacco products from as listed in Column A or B.

1

1 2

2