Print Form

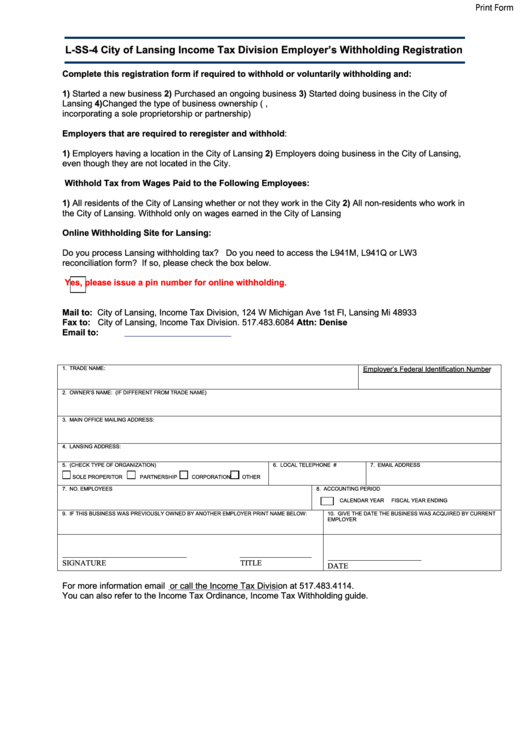

L-SS-4 City of Lansing Income Tax Division Employer’s Withholding Registration

Complete this registration form if required to withhold or voluntarily withholding and:

1) Started a new business 2) Purchased an ongoing business 3) Started doing business in the City of

Lansing 4) Changed the type of business ownership (e.g. from sole proprietorship to partnership,

incorporating a sole proprietorship or partnership)

Employers that are required to reregister and withhold:

1) Employers having a location in the City of Lansing 2) Employers doing business in the City of Lansing,

even though they are not located in the City.

Withhold Tax from Wages Paid to the Following Employees:

1) All residents of the City of Lansing whether or not they work in the City 2) All non-residents who work in

the City of Lansing. Withhold only on wages earned in the City of Lansing

Online Withholding Site for Lansing:

Do you process Lansing withholding tax? Do you need to access the L941M, L941Q or LW3

reconciliation form? If so, please check the box below.

Yes, please issue a pin number for online withholding.

Mail to:

City of Lansing, Income Tax Division, 124 W Michigan Ave 1st Fl, Lansing Mi 48933

Fax to:

City of Lansing, Income Tax Division. 517.483.6084 Attn: Denise

Email to:

Withholding@lansingmi.gov

1. TRADE NAME:

Employer’s Federal Identification Number

2. OWNER’S NAME: (IF DIFFERENT FROM TRADE NAME)

3. MAIN OFFICE MAILING ADDRESS:

4. LANSING ADDRESS:

5. (CHECK TYPE OF ORGANIZATION)

6. LOCAL TELEPHONE #

7. EMAIL ADDRESS

SOLE PROPERITOR

PARTNERSHIP

CORPORATION

OTHER

7. NO. EMPLOYEES

8. ACCOUNTING PERIOD

CALENDAR YEAR

FISCAL YEAR ENDING

9. IF THIS BUSINESS WAS PREVIOUSLY OWNED BY ANOTHER EMPLOYER PRINT NAME BELOW:

10. GIVE THE DATE THE BUSINESS WAS ACQUIRED BY CURRENT

EMPLOYER

SIGNATURE

TITLE

DATE

For more information email

withholding@ci.lansing.mi.us

or call the Income Tax Division at 517.483.4114.

You can also refer to the Income Tax Ordinance, Income Tax Withholding guide.

1

1