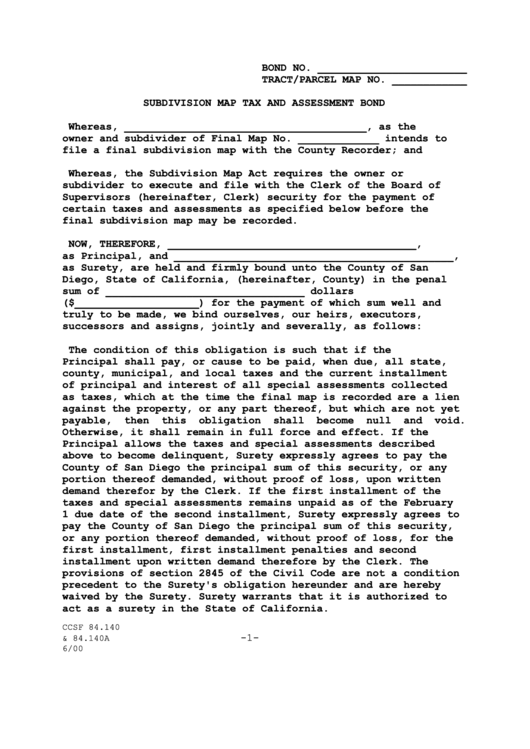

BOND NO. ________________________

TRACT/PARCEL MAP NO. ____________

SUBDIVISION MAP TAX AND ASSESSMENT BOND

Whereas,

_______________________________________,

as

the

owner and subdivider of Final Map No. _____________ intends to

file a final subdivision map with the County Recorder; and

Whereas, the Subdivision Map Act requires the owner or

subdivider to execute and file with the Clerk of the Board of

Supervisors (hereinafter, Clerk) security for the payment of

certain taxes and assessments as specified below before the

final subdivision map may be recorded.

NOW,

THEREFORE,

________________________________________,

as Principal, and _____________________________________________,

as Surety, are held and firmly bound unto the County of San

Diego, State of California, (hereinafter, County) in the penal

sum

of

________________________________

dollars

($____________________) for the payment of which sum well and

truly

to

be

made,

we

bind

ourselves,

our

heirs,

executors,

successors and assigns, jointly and severally, as follows:

The

condition

of

this

obligation

is

such

that

if

the

Principal shall pay, or cause to be paid, when due, all state,

county, municipal, and local taxes and the current installment

of principal and interest of all special assessments collected

as taxes, which at the time the final map is recorded are a lien

against the property, or any part thereof, but which are not yet

payable,

then

this

obligation

shall

become

null

and

void.

Otherwise, it shall remain in full force and effect. If the

Principal allows the taxes and special assessments described

above to become delinquent, Surety expressly agrees to pay the

County of San Diego the principal sum of this security, or any

portion thereof demanded, without proof of loss, upon written

demand therefor by the Clerk. If the first installment of the

taxes and special assessments remains unpaid as of the February

1 due date of the second installment, Surety expressly agrees to

pay the County of San Diego the principal sum of this security,

or any portion thereof demanded, without proof of loss, for the

first

installment,

first

installment

penalties

and

second

installment upon

written

demand

therefore by the Clerk.

The

provisions of section 2845 of the Civil Code are not a condition

precedent to the Surety's obligation hereunder and are hereby

waived by the Surety. Surety warrants that it is authorized to

act as a surety in the State of California.

CCSF 84.140

-1-

& 84.140A

6/00

1

1 2

2