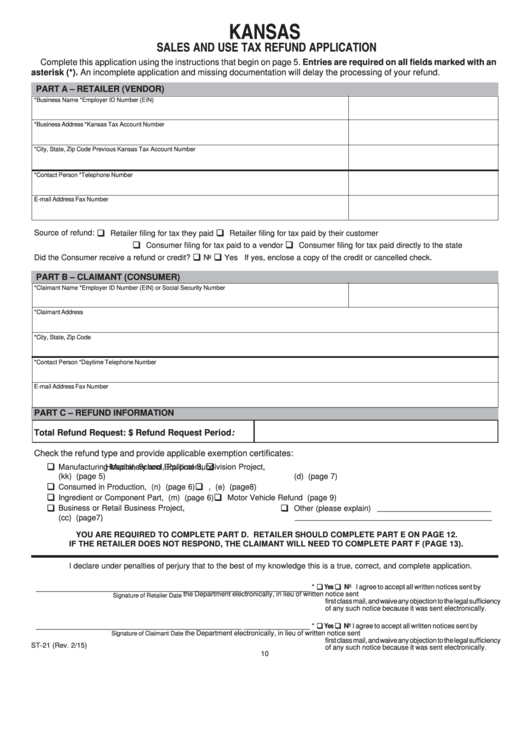

KANSAS

SALES AND USE TAX REFUND APPLICATION

Complete this application using the instructions that begin on page 5. Entries are required on all fields marked with an

asterisk (*). An incomplete application and missing documentation will delay the processing of your refund.

PART A – RETAILER (VENDOR)

*Business Name

*Employer ID Number (EIN)

*Business Address

*Kansas Tax Account Number

*City, State, Zip Code

Previous Kansas Tax Account Number

*Contact Person

*Telephone Number

E-mail Address

Fax Number

‰

‰

Source of refund:

Retailer filing for tax they paid

Retailer filing for tax paid by their customer

‰

‰

Consumer filing for tax paid to a vendor

Consumer filing for tax paid directly to the state

‰

‰

Did the Consumer receive a refund or credit?

No

Yes If yes, enclose a copy of the credit or cancelled check.

PART B – CLAIMANT (CONSUMER)

*Claimant Name

*Employer ID Number (EIN) or Social Security Number

*Claimant Address

*City, State, Zip Code

*Contact Person

*Daytime Telephone Number

E-mail Address

Fax Number

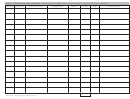

PART C – REFUND INFORMATION

Total Refund Request:

$

Refund Request Period:

Check the refund type and provide applicable exemption certificates:

‰

‰

Manufacturing Machinery and Equipment,

Hospital, School, Political Subdivision Project,

K.S.A.79-3606(kk) (page 5)

K.S.A. 79-3606(d) (page 7)

‰

‰

Consumed in Production, K.S.A.79-3606(n) (page 6)

U.S. Government Project, K.S.A.79-3606(e) (page 8)

‰

‰

Ingredient or Component Part, K.S.A.79-3606(m) (page 6)

Motor Vehicle Refund (page 9)

‰

‰

__________________________

Business or Retail Business Project,

Other (please explain)

_____________________________________________

K.S.A.79-3606(cc) (page 7)

YOU ARE REQUIRED TO COMPLETE PART D. RETAILER SHOULD COMPLETE PART E ON PAGE 12.

IF THE RETAILER DOES NOT RESPOND, THE CLAIMANT WILL NEED TO COMPLETE PART F (PAGE 13).

I declare under penalties of perjury that to the best of my knowledge this is a true, correct, and complete application.

‰

Yes

‰

*

No I agree to accept all written notices sent by

_______________________________________________

_______________

the Department electronically, in lieu of written notice sent

Signature of Retailer

Date

first class mail, and waive any objection to the legal sufficiency

of any such notice because it was sent electronically.

‰

Yes

‰

_______________________________________________

_______________

*

No I agree to accept all written notices sent by

the Department electronically, in lieu of written notice sent

Signature of Claimant

Date

first class mail, and waive any objection to the legal sufficiency

ST-21 (Rev. 2/15)

of any such notice because it was sent electronically.

10

1

1 2

2 3

3 4

4