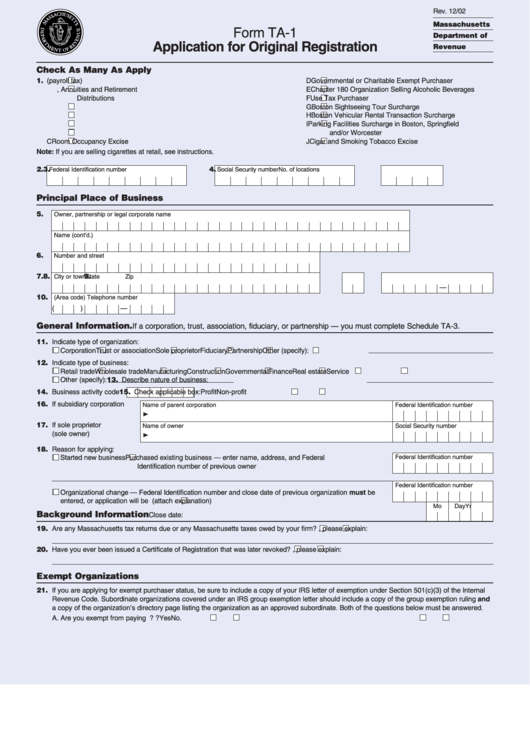

Form Ta-1 - Application For Original Registration - 2002

ADVERTISEMENT

Rev. 12/02

Massachusetts

Form TA-1

Department of

Application for Original Registration

Revenue

Check As Many As Apply

1. A 1.

Employer under the Income Tax Withholding Law (payroll tax)

D

Governmental or Charitable Exempt Purchaser

2.

Withholding for Pension Plans, Annuities and Retirement

E

Chapter 180 Organization Selling Alcoholic Beverages

Distributions

F

Use Tax Purchaser

B 1.

Sales/Use Tax on Goods Vendor

G

Boston Sightseeing Tour Surcharge

2.

Sales/Use Tax on Telecommunications Services Vendor

H

Boston Vehicular Rental Transaction Surcharge

3.

Meals Tax on Food and All Beverages

I

Parking Facilities Surcharge in Boston, Springfield

4.

Purchasing in MA for Out-of-State Resale Only

and/or Worcester

C

Room Occupancy Excise

J

Cigar and Smoking Tobacco Excise

Note: If you are selling cigarettes at retail, see instructions.

2.

3.

4.

Federal Identification number

Social Security number

No. of locations

Principal Place of Business

5.

Owner, partnership or legal corporate name

Name (cont’d.)

6.

Number and street

7.

8.

9.

City or town

State

Zip

—

10.

(Area code) Telephone number

(

)

—

General Information.

If a corporation, trust, association, fiduciary, or partnership — you must complete Schedule TA-3.

11. Indicate type of organization:

Corporation

Trust or association

Sole proprietor

Fiduciary

Partnership

Other (specify):

12. Indicate type of business:

Retail trade

Wholesale trade

Manufacturing

Construction

Governmental

Finance

Real estate

Service

Other (specify):

13. Describe nature of business:

14. Business activity code

15. Check applicable box:

Profit

Non-profit

16. If subsidiary corporation

Name of parent corporation

Federal Identification number

❿

17. If sole proprietor

Name of owner

Social Security number

(sole owner)

❿

18. Reason for applying:

Federal Identification number

Started new business

Purchased existing business — enter name, address, and Federal

Identification number of previous owner

Federal Identification number

Organizational change — Federal Identification number and close date of previous organization must be

entered, or application will be returned.

Other (attach explanation)

Mo

Day

Yr

Background Information

Close date:

19. Are any Massachusetts tax returns due or any Massachusetts taxes owed by your firm?

Yes

No. If yes, please explain:

20. Have you ever been issued a Certificate of Registration that was later revoked?

Yes

No. If yes, please explain:

Exempt Organizations

21. If you are applying for exempt purchaser status, be sure to include a copy of your IRS letter of exemption under Section 501(c)(3) of the Internal

Revenue Code. Subordinate organizations covered under an IRS group exemption letter should include a copy of the group exemption ruling and

a copy of the organization’s directory page listing the organization as an approved subordinate. Both of the questions below must be answered.

A. Are you exempt from paying U.S. income taxes?

Yes

No. B. Are you exempt from paying local property taxes?

Yes

No.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2