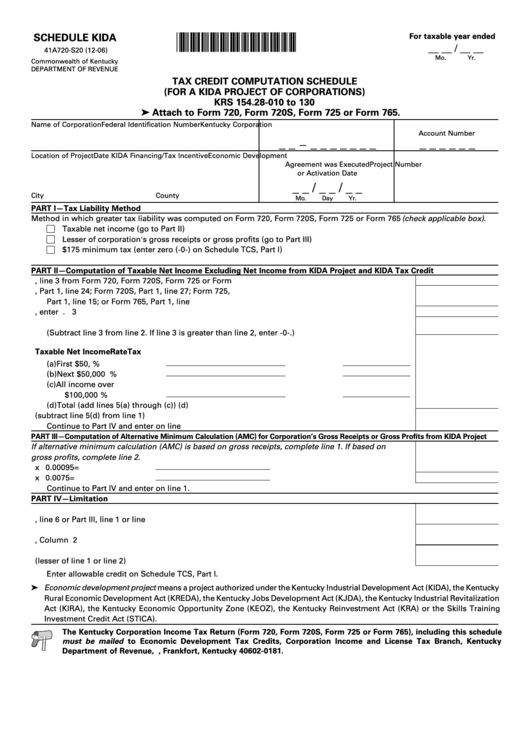

Form 41a720-S20 - Schedule Kida - Tax Credit Computation Schedule

ADVERTISEMENT

*0600010241*

For taxable year ended

SCHEDULE KIDA

__ __ / __ __

41A720-S20 (12-06)

Mo.

Yr.

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

TAX CREDIT COMPUTATION SCHEDULE

(FOR A KIDA PROJECT OF CORPORATIONS)

KRS 154.28-010 to 130

➤ Attach to Form 720, Form 720S, Form 725 or Form 765.

Name of Corporation

Federal Identification Number

Kentucky Corporation

Account Number

_ _

_ _ _ _ _ _ _

_ _ _ _ _ _

—

Location of Project

Date KIDA Financing/Tax Incentive

Economic Development

Agreement was Executed

Project Number

or Activation Date

_ _ / _ _ / _ _

City

County

Mo.

Day

Yr.

PART I—Tax Liability Method

Method in which greater tax liability was computed on Form 720, Form 720S, Form 725 or Form 765 (check applicable box) .

Taxable net income (go to Part II)

Lesser of corporation's gross receipts or gross profits (go to Part III)

$175 minimum tax (enter zero (-0-) on Schedule TCS, Part I)

PART II—Computation of Taxable Net Income Excluding Net Income from KIDA Project and KIDA Tax Credit

1. Enter total tax liability from Part 3, line 3 from Form 720, Form 720S, Form 725 or Form 765.......

1

2. Enter taxable net income from Form 720, Part 1, line 24; Form 720S, Part 1, line 27; Form 725,

Part 1, line 15; or Form 765, Part 1, line 29 ........................................................................................... 2

3. Enter net income from KIDA project. If a loss, enter -0- ...................................................................... 3

4. Kentucky taxable net income excluding net income from KIDA project

(Subtract line 3 from line 2. If line 3 is greater than line 2, enter -0-.) ................................................ 4

5. Compute tax on amount on line 4.

Taxable Net Income

Rate

Tax

(a)

First $50,000 .....................

x

4%

(b)

Next $50,000 ....................

x

5%

(c)

All income over

$100,000 ...........................

x

7%

(d)

Total (add lines 5(a) through (c)) ................................................................................................ 5(d)

6. Income tax liability attributable to KIDA project (subtract line 5(d) from line 1)

Continue to Part IV and enter on line 1 ................................................................................................. 6

PART III—Computation of Alternative Minimum Calculation (AMC) for Corporation’s Gross Receipts or Gross Profits from KIDA Project

If alternative minimum calculation (AMC) is based on gross receipts, complete line 1. If based on

gross profits, complete line 2.

1. KIDA project gross receipts

x 0.00095 = ............................ 1

2. KIDA project gross profits

x 0.0075

= ............................ 2

Continue to Part IV and enter on line 1.

PART IV—Limitation

1. Enter tax liability attributable to KIDA project from Part II, line 6 or Part III, line 1 or line 2 ............ 1

2. Enter limitation from Schedule KIDA-T, Column D .............................................................................. 2

3. Allowable KIDA tax credit (lesser of line 1 or line 2) ........................................................................... 3

Enter allowable credit on Schedule TCS, Part I.

➤ Economic development project means a project authorized under the Kentucky Industrial Development Act (KIDA), the Kentucky

Rural Economic Development Act (KREDA), the Kentucky Jobs Development Act (KJDA), the Kentucky Industrial Revitalization

Act (KIRA), the Kentucky Economic Opportunity Zone (KEOZ), the Kentucky Reinvestment Act (KRA) or the Skills Training

Investment Credit Act (STICA).

The Kentucky Corporation Income Tax Return (Form 720, Form 720S, Form 725 or Form 765), including this schedule

must be mailed to Economic Development Tax Credits, Corporation Income and License Tax Branch, Kentucky

Department of Revenue, P.O. Box 181, Frankfort, Kentucky 40602-0181.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1