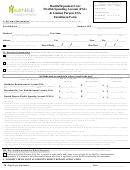

Form Clm-110 Dependent Care Flexible Spending Account Claim Form - Highmark Blue Cross Blue Shield Delaware Page 2

ADVERTISEMENT

EMPLOYEE CERTIFICATION SECTION

I certify that I have met all of the following requirements for the claims

7. I will not claim a dependent care tax credit or any other credit on my

federal income tax return for any expense reimbursed under this plan.

submitted for expenses incurred during the plan year. (See below for

Definitions and Special Rules.)

8. I certify that my pre-tax contribution ot the Dependent Care FSA will not

exceed the least of the following limits: (a) $5,000 ($2,500 if I am married and

1. I incurred the expenses to enable me (and my spouse, if married, unless

do not file a joint federal income tax return with my spouse for the current tax

my spouse is physically or mentally incapable of caring for himself or herself

year); (b) My taxable compensation for the year (after my pre-tax contribution

or a full-time student) to be gainfully employed or to look for gainful

to the dependent care spending account); (c) If I am married at the end of

employment. Expenses incurred while I am (or my spouse is, if married) not

current tax year, my spouse’s taxable compensation (after his or her pre-tax

at work (because of illness, vacation, etc.) do not count as work related

expenses, unless the absence is a “short” or “temporary” absence and I am

contribution to any dependent care spending account). For purposes of this

section, my spouse will be deemed to have taxable compensation of $250

required to pay for care on a weekly or longer basis.

($500 if I have 2 or more dependents described in paragraph 2 above), for

2. I incurred the expenses for the care of, or household services related to, a

each month in which my spouse is (i) physically or mentally incapable of

Qualifying Individual who is either (a) a dependent under age 13 or whom I

caring for himself or herself, or (ii) a full-time student at an educational

am the custodial parent and who may be claimed as an exemption on my

institution.

federal income tax return for the current tax year, (b) my spouse who is

9. Provider Information: If a correct and complete name, address and

physically or mentally incapable of caring for himself or herself and who

taxpayer identification number of the person or dependent day care center

resides in my household for more than one-half of the year or (c) any other

performing the dependent care services are not shown in the provider

relative or household member (regardless of age) who is physically or

information section of this claim form, on separate documentation attached

mentally incapable of caring for himself or herself, who is principally

to this claim form, or on IRS Form W-10 Dependent Care Provider’s

dependent on me for support and who resides in my household for more

Identification and Certification, it is because of one of the following reasons

than one-half of the year. (See special rules that are applicable in certain

circumstances where a noncustodial divorced or separated parent is

(check one):

entitled to claim the child as a dependent.)

q

I submitted information for this provider on a previous claim earlier in this

3. If I incurred the expenses for services outside of my household, they are

plan year; or

incurred for the care of a dependent who is described in 2(a) above, or for

q

I am not required to obtain the taxpayer identification number because the

the care of a spouse or other tax dependent who is described in 2(b) above

provider is a tax-exempt organization under Section 501 (c)(3) of the

and who regularly spends at least 8 hours per day in my household.

Internal Revenue Code (such as a church or school); or

q

4. If I incurred the expenses for services provided at a dependent day care

I requested this information from the provider but the provider did not

center (i.e., a facility that provides care for more than 6 individuals not

comply with my request.

residing at the facility), the center complies with all applicable state and

10. I agree to notify the Benefits Department of my employer if I have any

local laws and regulations, including licensing agreements.

reason to believe that any expense for which I have obtained reimbursement

5. If the services were performed by an individual, the expenses were not

is not a qualifying dependent care expense. If requested by my employer, I

paid or payable to a child of mine who is under age 19 by December 31, or

also agree to indemnify and reimburse my employer for any liability it may

to an individual for whom I (or my spouse, if married) can claim as a

incur for failure to withhold federal and state income tax and/or Social

dependent for the current tax year.

Security and Medicare tax from any reimbursement I receive of a non-

qualifying expense, up to the amount of additional tax actually owed by me.

6. The expenses claimed have not been paid or reimbursed by, and have not

been and will not be submitted for payment or reimbursement by, another

11. My employer may limit my reimbursement in the event it believes it

employer’s dependent care flexible spending account.

advisable in order to satisfy certain provisions of the Internal Revenue Code.

Employee’s Signature:

Date: _______/_______/_______

DEFINITIONS AND SPECIAL RULES

Special Rules that are applicable in certain circumstances where a

Eligible care only includes the cost of services for the individual’s well-

noncustodial divorced or separated parent is entitled to claim the child as a

being and safety. Amounts paid for the cost of items other than the care of

dependent.

your spouse or dependent (such as food, and schooling for a child prior to

kindergarten) may be included only if the items are incidental to the care of

If I am divorced, legally separated, or live apart from my spouse during the

the individual and cannot be separated from the total cost. Do not include:

the cost of: (i) clothing, (ii) entertainment, (iii) sending your dependent to

last six (6) months of the current tax year, I can treat my child as a Qualifying

Individual even if I cannot claim my child as a dependent for the current tax

an overnight camp, or (iv) schooling for a child in kindergarten and above.

year, if all five (5) of the following are true: (a) I have or had custody of the

child for a longer time in the current tax year than the other parent; (b) I or

Gainfully employed means that I am working for an organization for wages

either full-time or part-time and my spouse, if married, is either working for

both parents provide more than half of the child’s support for the current tax

year; (c) I or both parents have or had custody of the child for more than half

an organization for wages, or in his or her own business or partnership,

either full-time or part-time. Neither I am (nor my spouse, if married) is

of the current calendar year; (d) The child was under age 13 or was disabled

and could not care himself or herself; and, (e) The other parent claims the

gainfully employed if I do or he/she does unpaid volunteer work or

volunteer work for a nominal salary.

child as a dependent for the current tax year because: (i) As the custodial

parent, I signed IRS Form 8332, Release of Claim to Exemption for Child of

Household Services are services needed to care for the person as well as to

Divorced or Separated Parents, or a similar statement agreeing not to claim

the child’s exemption for the current tax year; or (ii) My divorce decree or

run the home. Examples are the services of a cook, maid, babysitter,

written agreement went into effect before 1985 and it states that the other

housekeeper, or cleaning person if the services were partly for the care of

parent can claim the child as a dependent, and the other parent gave at least

the individual. Do not include services of a chauffeur or gardner.

$600 for the child’s support in the current tax year. This rule does not apply

if my decree or agreement was changed after 1984 to say that the other

parent cannot claim the child as a dependent.

Attach copies of the required documentation to this form and send to:

Highmark Blue Cross Blue Shield Delaware

Flexible Benefits Department

P.O. Box 8737

Wilmington, DE 19899-8737

Highmark Blue Cross Blue Shield Delaware is an independent licensee of the Blue Cross and Blue Shield Association

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2