Audit Checklist County Assessor Audit Interview And Checklist Template Page 4

ADVERTISEMENT

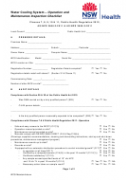

Appendix D

YES

NO

C.

Do they lease equipment to "related" entities at a lower value

than those unrelated?

____

____

D.

Do they lease equipment originally purchased from a parent or

subsidiary company in which they receive a discounted purchase

price?

____

____

E.

Were lease contract agreements reviewed?

____

____

6.

BUILDING, LAND, AND LEASEHOLD IMPROVEMENTS

A.

Was the appraisal record reviewed while on a situs review?

____

____

B.

Was a detailed schedule of these items obtained?

____

____

C.

Were trade fixtures identified?

____

____

D.

Was a determination made whether expensed items should have

been capitalized as real property additions or trade fixtures?

____

____

E.

Was it noted whether capitalized items were repairs and/or new

additions?

____

____

F.

Have items been posted to the real estate account since the last

appraisal?

____

____

G.

Do leasehold improvement items left from the previous tenant

affect the appraisal?

____

____

H.

Are any fixtures included in the real property appraisal?

____

____

I.

Have any leased trade fixtures been reflected on the books as

purchased after the lease terminated?

____

____

J.

If the property is tenant-occupied, do there appear to be trade

fixtures which should be reported by the real property owner?

____

____

7.

CONSTRUCTION-IN-PROGRESS

A.

Do the books reflect CIP on any of the lien dates?

____

____

B.

If there was CIP, are the payables accrued properly for the lien

cut off?

____

____

C.

Are there periodic progress billings from the contractor?

____

____

D.

Were any invoice reviewed which were paid after lien date?

____

____

AH 504

205

June 2000

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5