Print form

Clear form

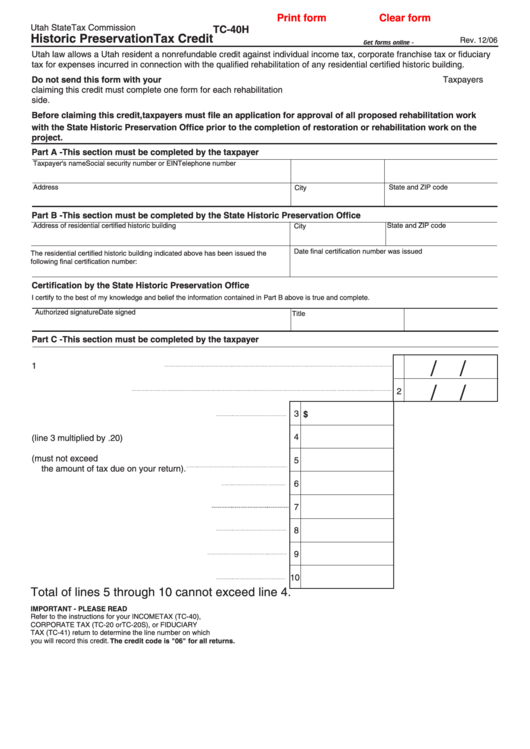

Utah State Tax Commission

TC-40H

Historic Preservation Tax Credit

Rev. 12/06

Get forms online - tax.utah.gov

Utah law allows a Utah resident a nonrefundable credit against individual income tax, corporate franchise tax or fiduciary

tax for expenses incurred in connection with the qualified rehabilitation of any residential certified historic building.

Do not send this form with your return. Keep this form and all related documents with your records.

Taxpayers

claiming this credit must complete one form for each rehabilitation claimed. See procedure instructions on the reverse

side.

Before claiming this credit, taxpayers must file an application for approval of all proposed rehabilitation work

with the State Historic Preservation Office prior to the completion of restoration or rehabilitation work on the

project.

Part A - This section must be completed by the taxpayer

Taxpayer's name

Telephone number

Social security number or EIN

Address

State and ZIP code

City

Part B - This section must be completed by the State Historic Preservation Office

Address of residential certified historic building

State and ZIP code

City

Date final certification number was issued

The residential certified historic building indicated above has been issued the

following final certification number:

Certification by the State Historic Preservation Office

I certify to the best of my knowledge and belief the information contained in Part B above is true and complete.

Authorized signature

Date signed

Title

Part C - This section must be completed by the taxpayer

/

/

1. Date of original project approval

1

/

/

2. Date project completed

2

3

3. Total amount of the Historic Preservation cost

$

4

4. Total amount of tax credit from project (line 3 multiplied by .20)

5. Amount of Historic credit used in year one (must not exceed

5

the amount of tax due on your return).

6

6. Amount of Historic tax credit used second year

7. Amount of Historic tax credit used third year

7

8. Amount of Historic tax credit used fourth year

8

9. Amount of Historic tax credit used fifth year

9

10

10. Amount of Historic tax credit used sixth year

Total of lines 5 through 10 cannot exceed line 4.

IMPORTANT - PLEASE READ

Refer to the instructions for your INCOME TAX (TC-40),

CORPORATE TAX (TC-20 or TC-20S), or FIDUCIARY

TAX (TC-41) return to determine the line number on which

The credit code is "06" for all returns.

you will record this credit.

1

1