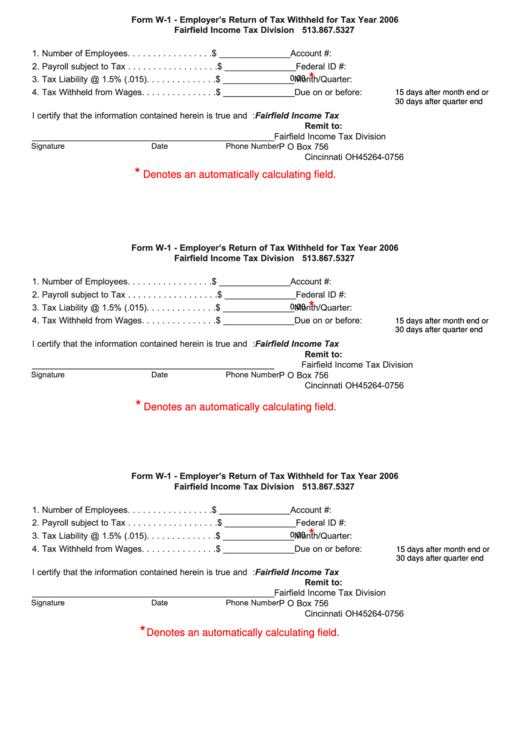

Form W-1 - Employer’s Return of Tax Withheld for Tax Year 2006

Fairfield Income Tax Division 513.867.5327

1. Number of Employees . . . . . . . . . . . . . . . . .

$ _______________

Account #:

2. Payroll subject to Tax . . . . . . . . . . . . . . . . . .

$ _______________

Federal ID #:

*

3. Tax Liability @ 1.5% (.015) . . . . . . . . . . . . . .

$ _______________

Month/Quarter:

0.00

4. Tax Withheld from Wages . . . . . . . . . . . . . . .

$ _______________

Due on or before:

15 days after month end or

30 days after quarter end

I certify that the information contained herein is true and correct.

Make check payable to: Fairfield Income Tax

Remit to:

___________________________________________________

Fairfield Income Tax Division

Signature

Date

Phone Number

P O Box 756

Cincinnati OH 45264-0756

*

Denotes an automatically calculating field.

Form W-1 - Employer’s Return of Tax Withheld for Tax Year 2006

Fairfield Income Tax Division 513.867.5327

1. Number of Employees . . . . . . . . . . . . . . . . .

$ _______________

Account #:

2. Payroll subject to Tax . . . . . . . . . . . . . . . . . .

$ _______________

Federal ID #:

*

3. Tax Liability @ 1.5% (.015) . . . . . . . . . . . . . .

$ _______________

Month/Quarter:

0.00

4. Tax Withheld from Wages . . . . . . . . . . . . . . .

$ _______________

Due on or before:

15 days after month end or

30 days after quarter end

I certify that the information contained herein is true and correct.

Make check payable to: Fairfield Income Tax

Remit to:

___________________________________________________

Fairfield Income Tax Division

Signature

Date

Phone Number

P O Box 756

Cincinnati OH 45264-0756

*

Denotes an automatically calculating field.

Form W-1 - Employer’s Return of Tax Withheld for Tax Year 2006

Fairfield Income Tax Division 513.867.5327

1. Number of Employees . . . . . . . . . . . . . . . . .

$ _______________

Account #:

2. Payroll subject to Tax . . . . . . . . . . . . . . . . . .

$ _______________

Federal ID #:

*

3. Tax Liability @ 1.5% (.015) . . . . . . . . . . . . . .

$ _______________

Month/Quarter:

0.00

4. Tax Withheld from Wages . . . . . . . . . . . . . . .

$ _______________

Due on or before:

15 days after month end or

30 days after quarter end

I certify that the information contained herein is true and correct.

Make check payable to: Fairfield Income Tax

Remit to:

___________________________________________________

Fairfield Income Tax Division

Signature

Date

Phone Number

P O Box 756

Cincinnati OH 45264-0756

*

Denotes an automatically calculating field.

1

1