Form 105-Ep - Estimated Tax Payment Voucher (2000)

ADVERTISEMENT

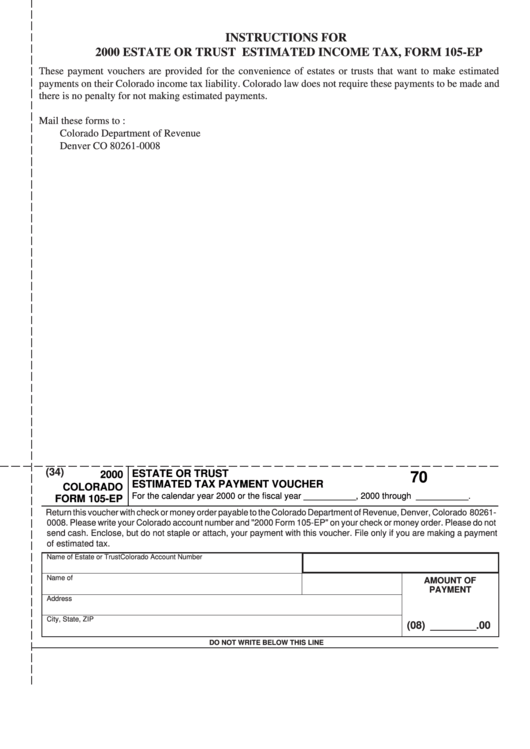

INSTRUCTIONS FOR

2000 ESTATE OR TRUST ESTIMATED INCOME TAX, FORM 105-EP

These payment vouchers are provided for the convenience of estates or trusts that want to make estimated

payments on their Colorado income tax liability. Colorado law does not require these payments to be made and

there is no penalty for not making estimated payments.

Mail these forms to :

Colorado Department of Revenue

Denver CO 80261-0008

(34)

ESTATE OR TRUST

2000

70

ESTIMATED TAX PAYMENT VOUCHER

COLORADO

For the calendar year 2000 or the fiscal year ___________, 2000 through ___________.

FORM 105-EP

Return this voucher with check or money order payable to the Colorado Department of Revenue, Denver, Colorado 80261-

0008. Please write your Colorado account number and "2000 Form 105-EP" on your check or money order. Please do not

send cash. Enclose, but do not staple or attach, your payment with this voucher. File only if you are making a payment

of estimated tax.

Name of Estate or Trust

Colorado Account Number

Name of Fiduciary

F.E.I.N.

AMOUNT OF

PAYMENT

Address

City, State, ZIP

(08) ________ .00

DO NOT WRITE BELOW THIS LINE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1