20__

17

17

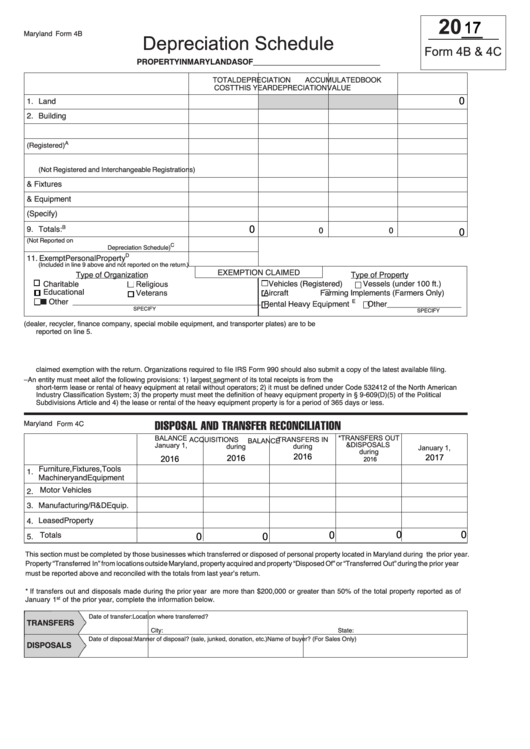

Maryland Form 4B

Depreciation Schedule

Form 4B & 4C

PROPERTY IN MARYLAND AS OF

_____________________________

TOTAL

DEPRECIATION

ACCUMULATED

BOOK

COST

THIS YEAR

DEPRECIATION

VALUE

1. Land

0

2. Building

3. Leasehold Improvements

4. Transportation Equipment

(Registered)

A

5. Transportation Equipment

(Not Registered and Interchangeable Registrations)

6. Furniture & Fixtures

7. Machinery & Equipment

8. Other (Specify)

9. Totals:

B

0

0

0

0

10. Expensed Property

(Not Reported on

C

Depreciation Schedule)

11. Exempt Personal Property

D

(Included in line 9 above and not reported on the return.)

EXEMPTION CLAIMED

Type of Organization

Type of Property

C haritable

Vehicles (Registered)

Vessels (under 100 ft.)

I

I

I

Educational

Aircraft

Farming Implements (Farmers Only)

Religious

I

I

Other ___________________________________________

Veterans

Rental Heavy Equipment

Other_________________

I I

I

I

E

SPECIFY

SPECIFY

A. Vehicles with Interchangeable Registrations (dealer, recycler, finance company, special mobile equipment, and transporter plates) are to be

reported on line 5.

B. Total line must equal Line 10 on the Balance Sheet Form 4A.

C. Include all expensed property located in Maryland not reported on the Depreciation Schedule Form 4B.

D. If exempt property is owned check the appropriate boxes under line 11. Exempt organizations need to provide written justification for the

claimed exemption with the return. Organizations required to file IRS Form 990 should also submit a copy of the latest available filing.

E. For Rental Heavy Equipment Only – An entity must meet all of the following provisions: 1) largest segment of its total receipts is from the

short-term lease or rental of heavy equipment at retail without operators; 2) it must be defined under Code 532412 of the North American

Industry Classification System; 3) the property must meet the definition of heavy equipment property in § 9-609(D)(5) of the Political

Subdivisions Article and 4) the lease or rental of the heavy equipment property is for a period of 365 days or less.

Maryland Form 4C

DISPOSAL AND TRANSFER RECONCILIATION

*TRANSFERS OUT

BALANCE

ACQUISITIONS

TRANSFERS IN

BALANCE

January 1,

& DISPOSALS

during

during

January 1,

during

2016

2017

2016

2016

1. Furniture, Fixtures, Tools

2016

Machinery and Equipment

Motor Vehicles

2.

Manufacturing/R&D Equip.

3.

Leased Property

4.

Totals

0

0

0

0

0

5.

This section must be completed by those businesses which transferred or disposed of personal property located in Maryland during the prior year.

Property “Transferred In” from locations outside Maryland, property acquired and property “Disposed Of” or “Transferred Out” during the prior year

must be reported above and reconciled with the totals from last year’s return.

* If transfers out and disposals made during the prior year are more than $200,000 or greater than 50% of the total property reported as of

January 1

st

of the prior year, complete the information below.

Date of transfer:

Location where transferred?

TRANSFERS

City:

State:

Date of disposal:

Manner of disposal? (sale, junked, donation, etc.)

Name of buyer? (For Sales Only)

DISPOSALS

1

1