Form Ftb 8633 California E-File Program Participant Enrollment

ADVERTISEMENT

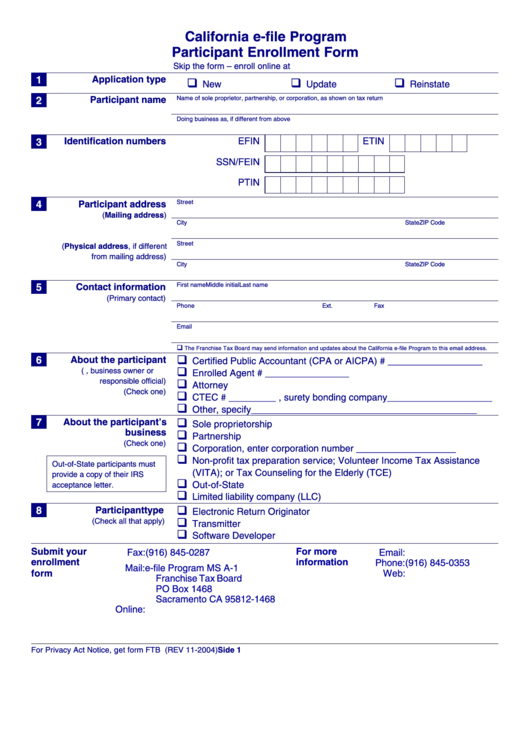

California e-file Program

Participant Enrollment Form

Skip the form – enroll online at

1

Application type

New

Update

Reinstate

Name of sole proprietor, partnership, or corporation, as shown on tax return

2

Participant name

Doing business as, if different from above

Identification numbers

EFIN

ETIN

3

SSN/FEIN

PTIN

Street

4

Participant address

(Mailing address)

City

State

ZIP Code

Street

(Physical address, if different

from mailing address)

City

State

ZIP Code

First name

Middle initial

Last name

5

Contact information

(Primary contact)

Phone

Ext.

Fax

Email

The Franchise Tax Board may send information and updates about the California e-file Program to this email address.

6

About the participant

Certified Public Accountant (CPA or AICPA) # __________________

(e.g., business owner or

Enrolled Agent # ________________

responsible official)

Attorney

(Check one)

CTEC # _________ , surety bonding company____________________

Other, specify___________________________________________

7

About the participant’s

Sole proprietorship

business

Partnership

(Check one)

Corporation, enter corporation number ___________________

Non-profit tax preparation service; Volunteer Income Tax Assistance

Out-of-State participants must

(VITA); or Tax Counseling for the Elderly (TCE)

provide a copy of their IRS

Out-of-State

acceptance letter.

Limited liability company (LLC)

8

Participant type

Electronic Return Originator

(Check all that apply)

Transmitter

Software Developer

Submit your

For more

Fax:

(916) 845-0287

Email:

e-file@ftb.ca.gov

enrollment

information

Phone: (916) 845-0353

Mail:

e-file Program MS A-1

form

Web:

Franchise Tax Board

PO Box 1468

Sacramento CA 95812-1468

Online:

For Privacy Act Notice, get form FTB 1131.

FTB 8633 (REV 11-2004) Side 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1