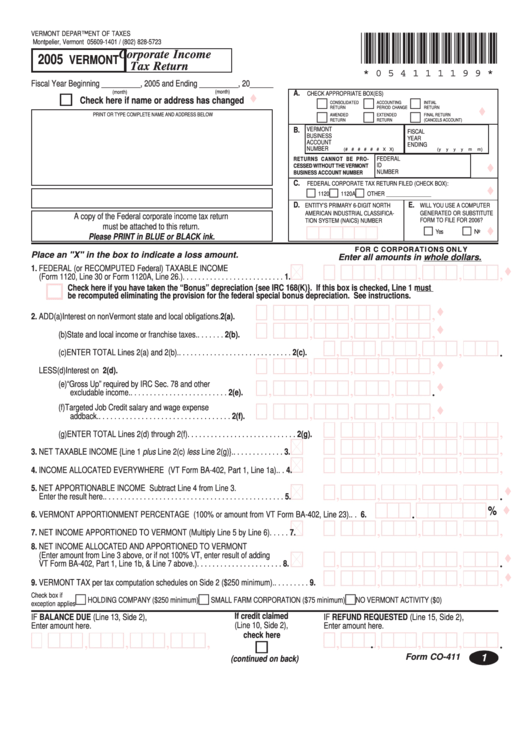

Form Co-411 - Vermont Corporate Income Tax Return - 2005

ADVERTISEMENT

VERMONT DEPARTMENT OF TAXES

*054111199*

Montpelier, Vermont 05609-1401 / (802) 828-5723

VERMONT Corporate Income

2005

Tax Return

* 0 5 4 1 1 1 1 9 9 *

Fiscal Year Beginning __________, 2005 and Ending __________, 20______

(month)

(month)

A.

CHECK APPROPRIATE BOX(ES)

Check here if name or address has changed

CONSOLIDATED

ACCOUNTING

INITIAL

RETURN

PERIOD CHANGE

RETURN

PRINT OR TYPE COMPLETE NAME AND ADDRESS BELOW

AMENDED

EXTENDED

FINAL RETURN

RETURN

RETURN

(CANCELS ACCOUNT)

B.

VERMONT

FISCAL

BUSINESS

YEAR

ACCOUNT

ENDING

NUMBER

(# # # # # # X X)

(y

y

y

y

m

m)

RETURNS CANNOT BE PRO-

FEDERAL

ID

CESSED WITHOUT THE VERMONT

NUMBER

BUSINESS ACCOUNT NUMBER

C.

FEDERAL CORPORATE TAX RETURN FILED (CHECK BOX):

1120

1120A

OTHER ________________

D.

E.

ENTITY’S PRIMARY 6-DIGIT NORTH

WILL YOU USE A COMPUTER

GENERATED OR SUBSTITUTE

AMERICAN INDUSTRIAL CLASSIFICA-

A copy of the Federal corporate income tax return

FORM TO FILE FOR 2006?

TION SYSTEM (NAICS) NUMBER

must be attached to this return.

Yes

No

Please PRINT in BLUE or BLACK ink.

FOR C CORPORATIONS ONLY

Place an "X" in the box to indicate a loss amount.

Enter all amounts in whole dollars.

1. FEDERAL (or RECOMPUTED Federal) TAXABLE INCOME

,

,

,

,

.

(Form 1120, Line 30 or Form 1120A, Line 26.) . . . . . . . . . . . . . . . . . . . . . . . . . .

1.

Check here if you have taken the “Bonus” depreciation {see IRC 168(K)}. If this box is checked, Line 1 must

be recomputed eliminating the provision for the federal special bonus depreciation. See instructions.

,

,

,

,

.

2. ADD (a) Interest on nonVermont state and local obligations.

2(a).

,

,

,

,

.

(b) State and local income or franchise taxes. . . . . . . . 2(b).

,

,

,

,

.

(c) ENTER TOTAL Lines 2(a) and 2(b). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2(c).

,

,

,

,

.

LESS (d) Interest on U.S. Government obligations. . . . . . . . . 2(d).

(e) “Gross Up” required by IRC Sec. 78 and other

,

,

,

,

.

excludable income. . . . . . . . . . . . . . . . . . . . . . . . . . 2(e).

(f) Targeted Job Credit salary and wage expense

,

,

,

,

.

addback. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2(f).

,

,

,

,

.

(g) ENTER TOTAL Lines 2(d) through 2(f). . . . . . . . . . . . . . . . . . . . . . . . . . . . 2(g).

,

,

,

,

.

3. NET TAXABLE INCOME {Line 1 plus Line 2(c) less Line 2(g)}. . . . . . . . . . . . . .

3.

,

,

,

,

.

4. INCOME ALLOCATED EVERYWHERE (VT Form BA-402, Part 1, Line 1a). . .

4.

5. NET APPORTIONABLE INCOME Subtract Line 4 from Line 3.

,

,

,

,

.

Enter the result here. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

%

.

6. VERMONT APPORTIONMENT PERCENTAGE (100% or amount from VT Form BA-402, Line 23). . . 6.

,

,

,

,

.

7. NET INCOME APPORTIONED TO VERMONT (Multiply Line 5 by Line 6). . . . .

7.

8. NET INCOME ALLOCATED AND APPORTIONED TO VERMONT

(Enter amount from Line 3 above, or if not 100% VT, enter result of adding

,

,

,

,

.

VT Form BA-402, Part 1, Line 1b, & Line 7 above.) . . . . . . . . . . . . . . . . . . . . . .

8.

,

,

,

,

.

9. VERMONT TAX per tax computation schedules on Side 2 ($250 minimum). . . . . . . . . . 9.

Check box if

HOLDING COMPANY ($250 minimum)

SMALL FARM CORPORATION ($75 minimum)

NO VERMONT ACTIVITY ($0)

exception applies

If credit claimed

IF BALANCE DUE (Line 13, Side 2),

IF REFUND REQUESTED (Line 15, Side 2),

(Line 10, Side 2),

Enter amount here.

Enter amount here.

check here

,

,

,

,

,

,

,

,

.

.

Form CO-411

1

(continued on back)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2