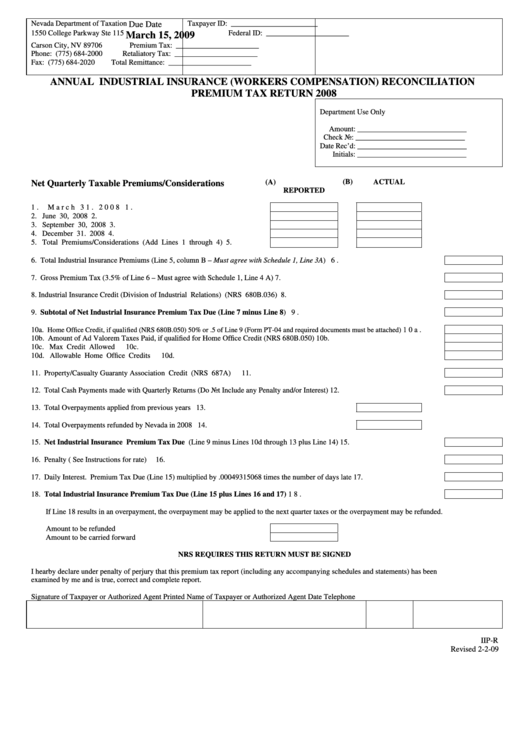

Form Iip-R - Annual Industrial Insurance (Workers Compensation) Reconciliation Premium Tax Return - 2008

ADVERTISEMENT

Nevada Department of Taxation

Taxpayer ID: _______________________

Due Date

1550 College Parkway Ste 115

Federal ID: ______________________

March 15, 2009

Carson City, NV 89706

Premium Tax: ______________________

Phone: (775) 684-2000

Retaliatory Tax: ______________________

Fax: (775) 684-2020

Total Remittance: ______________________

ANNUAL INDUSTRIAL INSURANCE (WORKERS COMPENSATION) RECONCILIATION

PREMIUM TAX RETURN 2008

Department Use Only

Amount: _____________________________

Check No: _____________________________

Date Rec’d: _____________________________

Initials: _____________________________

(A)

(B)

Net Quarterly Taxable Premiums/Considerations

REPORTED

ACTUAL

1. March 31. 2008

1.

2. June 30, 2008

2.

3. September 30, 2008

3.

4. December 31. 2008

4.

5. Total Premiums/Considerations (Add Lines 1 through 4)

5.

6. Total Industrial Insurance Premiums (Line 5, column B – Must agree with Schedule 1, Line 3A)

6.

7. Gross Premium Tax (3.5% of Line 6 – Must agree with Schedule 1, Line 4 A)

7.

8. Industrial Insurance Credit (Division of Industrial Relations) (NRS 680B.036)

8.

9. Subtotal of Net Industrial Insurance Premium Tax Due (Line 7 minus Line 8)

9.

10a.

10a.

Home Office Credit, if qualified (NRS 680B.050) 50% or .5 of Line 9 (Form PT-04 and required documents must be attached)

10b. Amount of Ad Valorem Taxes Paid, if qualified for Home Office Credit (NRS 680B.050)

10b.

10c. Max Credit Allowed

10c.

10d. Allowable Home Office Credits

10d.

11. Property/Casualty Guaranty Association Credit (NRS 687A)

11.

12. Total Cash Payments made with Quarterly Returns (Do Not Include any Penalty and/or Interest)

12.

13. Total Overpayments applied from previous years

13.

14. Total Overpayments refunded by Nevada in 2008

14.

15. Net Industrial Insurance Premium Tax Due (Line 9 minus Lines 10d through 13 plus Line 14)

15.

16. Penalty ( See Instructions for rate)

16.

17. Daily Interest. Premium Tax Due (Line 15) multiplied by .00049315068 times the number of days late

17.

18. Total Industrial Insurance Premium Tax Due (Line 15 plus Lines 16 and 17)

18.

If Line 18 results in an overpayment, the overpayment may be applied to the next quarter taxes or the overpayment may be refunded.

Amount to be refunded

Amount to be carried forward

NRS REQUIRES THIS RETURN MUST BE SIGNED

I hearby declare under penalty of perjury that this premium tax report (including any accompanying schedules and statements) has been

examined by me and is true, correct and complete report.

Signature of Taxpayer or Authorized Agent

Printed Name of Taxpayer or Authorized Agent

Date

Telephone

IIP-R

Revised 2-2-09

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4