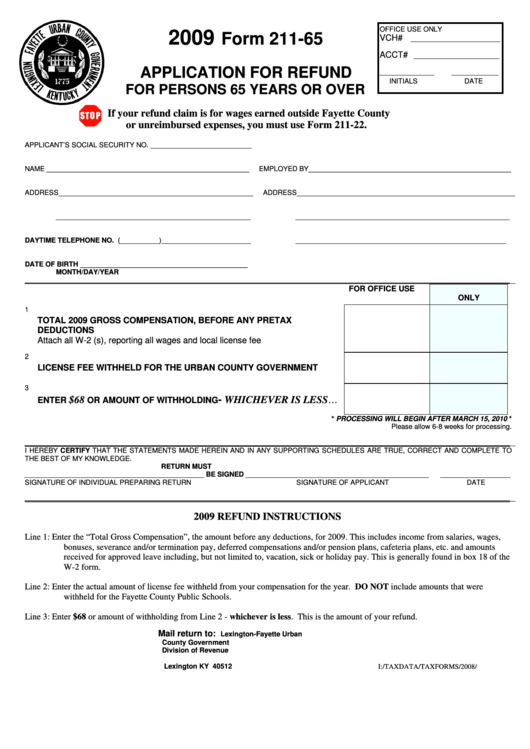

Form 211-65 - Application For Refund For Persons 65 Years Or Over - 2009

ADVERTISEMENT

OFFICE USE ONLY

2009

Form 211-65

VCH#

_______________________

ACCT#

______________________

APPLICATION FOR REFUND

______________

____________

INITIALS

DATE

FOR PERSONS 65 YEARS OR OVER

If your refund claim is for wages earned outside Fayette County

or unreimbursed expenses, you must use Form 211-22.

APPLICANT’S SOCIAL SECURITY NO. __________________________

NAME ____________________________________________________

EMPLOYED BY____________________________________________________

ADDRESS__________________________________________________

ADDRESS________________________________________________________

__________________________________________________

_______________________________________________________

DAYTIME TELEPHONE NO. (__________)_______________________

______________________________________________________

DATE OF BIRTH ___________________________________________

MONTH/DAY/YEAR

______________________________________________________________________________________________________________________________

FOR OFFICE USE

ONLY

1

TOTAL 2009 GROSS COMPENSATION, BEFORE ANY PRETAX

DEDUCTIONS

Attach all W-2 (s), reporting all wages and local license fee withholding..........

2

LICENSE FEE WITHHELD FOR THE URBAN COUNTY GOVERNMENT.......

3

- WHICHEVER IS LESS

$68

…

ENTER

OR AMOUNT OF WITHHOLDING

* PROCESSING WILL BEGIN AFTER MARCH 15, 2010 *

Please allow 6-8 weeks for processing.

______________________________________________________________________________________________________________________________

I HEREBY CERTIFY THAT THE STATEMENTS MADE HEREIN AND IN ANY SUPPORTING SCHEDULES ARE TRUE, CORRECT AND COMPLETE TO

THE BEST OF MY KNOWLEDGE.

RETURN MUST

______________________________________________ BE SIGNED _______________________________________________

__________________

SIGNATURE OF INDIVIDUAL PREPARING RETURN

SIGNATURE OF APPLICANT

DATE

______________________________________________________________________________________________________________________________

2009 REFUND INSTRUCTIONS

Line 1:

Enter the “Total Gross Compensation”, the amount before any deductions, for 2009. This includes income from salaries, wages,

bonuses, severance and/or termination pay, deferred compensations and/or pension plans, cafeteria plans, etc. and amounts

received for approved leave including, but not limited to, vacation, sick or holiday pay. This is generally found in box 18 of the

W-2 form.

Line 2:

Enter the actual amount of license fee withheld from your compensation for the year. DO NOT include amounts that were

withheld for the Fayette County Public Schools.

Line 3:

Enter $68 or amount of withholding from Line 2 - whichever is less. This is the amount of your refund.

Mail return to:

Lexington-Fayette Urban

County Government

Division of Revenue

P.O. Box 14058

Lexington KY 40512

I:/TAXDATA/TAXFORMS/2008/211-65.DOC

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1