Form C.s.t. 8 Foil I Exemption Certificate

ADVERTISEMENT

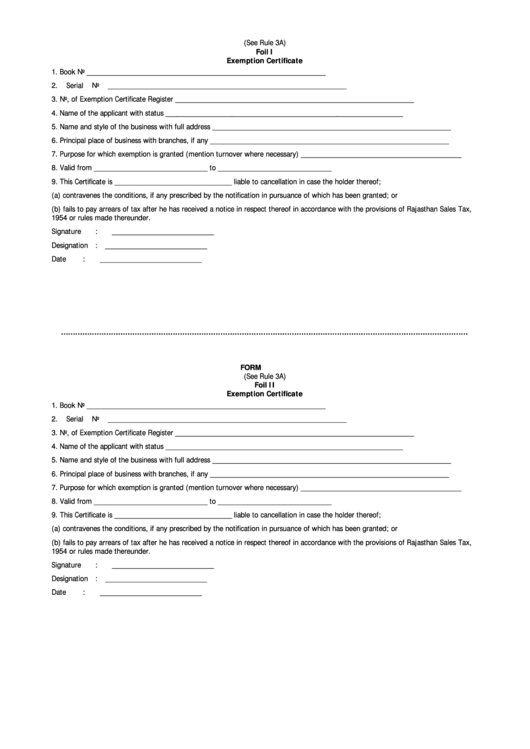

FORMC.S.T. 8

(See Rule 3A)

Foil I

Exemption Certificate

1.

Book No _____________________________________________________________

2.

Serial No _____________________________________________________________

3.

No, of Exemption Certificate Register _____________________________________________________________

4.

Name of the applicant with status _____________________________________________________________

5.

Name and style of the business with full address _____________________________________________________________

6.

Principal place of business with branches, if any _____________________________________________________________

7.

Purpose for which exemption is granted (mention turnover where necessary) _________________________________________

8.

Valid from _____________________________ to _____________________________

9.

This Certificate is ______________________________ liable to cancellation in case the holder thereof;

(a) contravenes the conditions, if any prescribed by the notification in pursuance of which has been granted; or

(b) fails to pay arrears of tax after he has received a notice in respect thereof in accordance with the provisions of Rajasthan Sales Tax,

1954 or rules made thereunder.

Signature

: __________________________

Designation : __________________________

Date

: __________________________

………………………………………………………………………………………………………………………………………………………

FORM C.S.T. 8

(See Rule 3A)

Foil II

Exemption Certificate

1.

Book No _____________________________________________________________

2.

Serial No _____________________________________________________________

3.

No, of Exemption Certificate Register _____________________________________________________________

4.

Name of the applicant with status _____________________________________________________________

5.

Name and style of the business with full address _____________________________________________________________

6.

Principal place of business with branches, if any _____________________________________________________________

7.

Purpose for which exemption is granted (mention turnover where necessary) _________________________________________

8.

Valid from _____________________________ to _____________________________

9.

This Certificate is ______________________________ liable to cancellation in case the holder thereof;

(a) contravenes the conditions, if any prescribed by the notification in pursuance of which has been granted; or

(b) fails to pay arrears of tax after he has received a notice in respect thereof in accordance with the provisions of Rajasthan Sales Tax,

1954 or rules made thereunder.

Signature

: __________________________

Designation : __________________________

Date

: __________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1