Net Proceeds Of Minerals Tax Partial Year Report And Payment 1 Form

ADVERTISEMENT

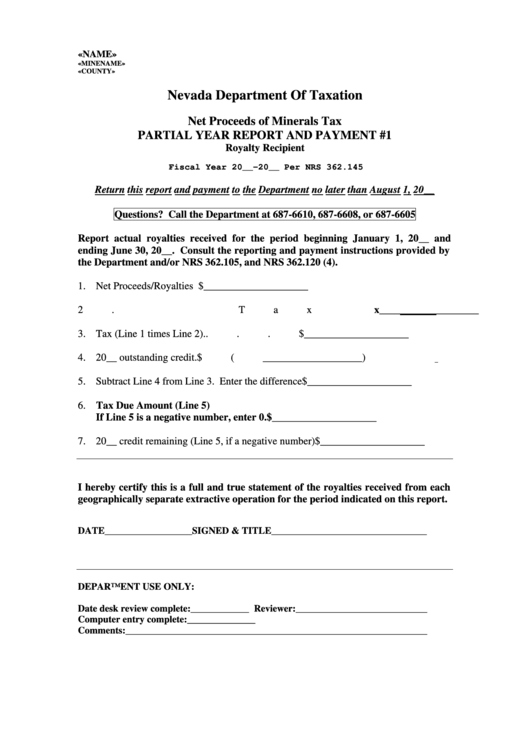

«NAME»

«MINENAME»

«COUNTY»

Nevada Department Of Taxation

Net Proceeds of Minerals Tax

PARTIAL YEAR REPORT AND PAYMENT #1

Royalty Recipient

Fiscal Year 20__-20__ Per NRS 362.145

Return this report and payment to the Department no later than August 1, 20__

Questions? Call the Department at 687-6610, 687-6608, or 687-6605

Report actual royalties received for the period beginning January 1, 20__ and

ending June 30, 20__. Consult the reporting and payment instructions provided by

the Department and/or NRS 362.105, and NRS 362.120 (4).

1. Net Proceeds/Royalties Received.

.

.

$____________________

2. Tax Rate. .

.

.

.

.

x___________________

3. Tax (Line 1 times Line 2).

.

.

.

$____________________

4. 20__ outstanding credit. .

.

.

.

$(___________________)

5. Subtract Line 4 from Line 3. Enter the difference

$____________________

6. Tax Due Amount (Line 5)

If Line 5 is a negative number, enter 0.

$____________________

7. 20__ credit remaining (Line 5, if a negative number)

$____________________

I hereby certify this is a full and true statement of the royalties received from each

geographically separate extractive operation for the period indicated on this report.

DATE__________________

SIGNED & TITLE________________________________

DEPARTMENT USE ONLY:

Date desk review complete:____________ Reviewer:___________________________

Computer entry complete:______________

Comments:______________________________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1