Affidavit For Qualification Of Motor Home, Boat, Watercraft, Or Camper For Residential Status Form - Pickens County Auditor

ADVERTISEMENT

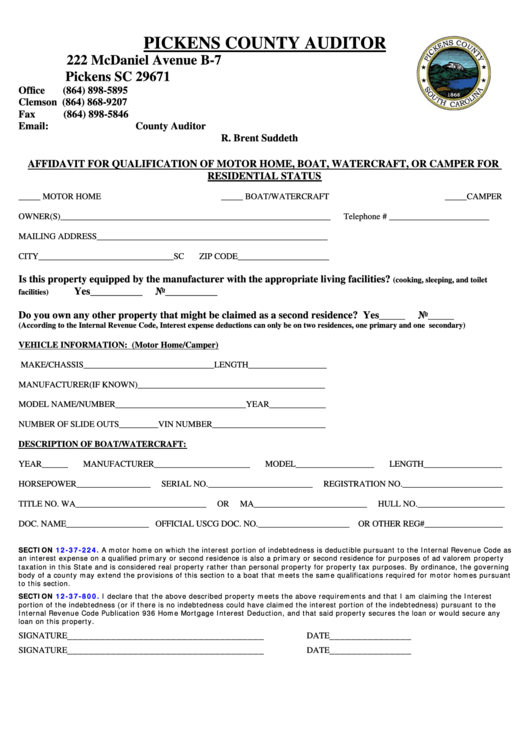

PICKENS COUNTY AUDITOR

222 McDaniel Avenue B-7

Pickens SC 29671

Office

(864) 898-5895

Clemson (864) 868-9207

Fax

(864) 898-5846

Email:

brents@co.pickens.sc.us

County Auditor

R. Brent Suddeth

AFFIDAVIT FOR QUALIFICATION OF MOTOR HOME, BOAT, WATERCRAFT, OR CAMPER FOR

RESIDENTIAL STATUS

_____ MOTOR HOME

_____ BOAT/WATERCRAFT

_____CAMPER

OWNER(S)______________________________________________________________

Telephone # _______________________

MAILING ADDRESS_____________________________________________________

CITY_______________________________SC

ZIP CODE_____________________

Is this property equipped by the manufacturer with the appropriate living facilities?

(cooking, sleeping, and toilet

Yes__________

No__________

facilities)

Do you own any other property that might be claimed as a second residence? Yes_____

No_____

(According to the Internal Revenue Code, Interest expense deductions can only be on two residences, one primary and one secondary)

VEHICLE INFORMATION: (Motor Home/Camper)

MAKE/CHASSIS______________________________LENGTH__________________

MANUFACTURER(IF KNOWN)___________________________________________

MODEL NAME/NUMBER______________________________YEAR_____________

NUMBER OF SLIDE OUTS_________VIN NUMBER__________________________

DESCRIPTION OF BOAT/WATERCRAFT:

YEAR______

MANUFACTURER______________________

MODEL__________________

LENGTH__________________

HORSEPOWER_________________

SERIAL NO.________________________

REGISTRATION NO._______________________

TITLE NO. WA______________________________

OR

MA__________________________

HULL NO.____________________

DOC. NAME___________________ OFFICIAL USCG DOC. NO._____________________ OR OTHER REG#__________________

SECTION

12-37-224.

A motor home on which the interest portion of indebtedness is deductible pursuant to the Internal Revenue Code as

an interest expense on a qualified primary or second residence is also a primary or second residence for purposes of ad valorem property

taxation in this State and is considered real property rather than personal property for property tax purposes. By ordinance, the governing

body of a county may extend the provisions of this section to a boat that meets the same qualifications required for motor homes pursuant

to this section.

SECTION

12-37-800.

I declare that the above described property meets the above requirements and that I am claiming the Interest

portion of the indebtedness (or if there is no indebtedness could have claimed the interest portion of the indebtedness) pursuant to the

Internal Revenue Code Publication 936 Home Mortgage Interest Deduction, and that said property secures the loan or would secure any

loan on this property.

SIGNATURE____________________________________

DATE_______________

SIGNATURE____________________________________

DATE_______________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1