Form S-207 - Wisconsin Certificate Of Exemption (Single Purchase/continuous)

ADVERTISEMENT

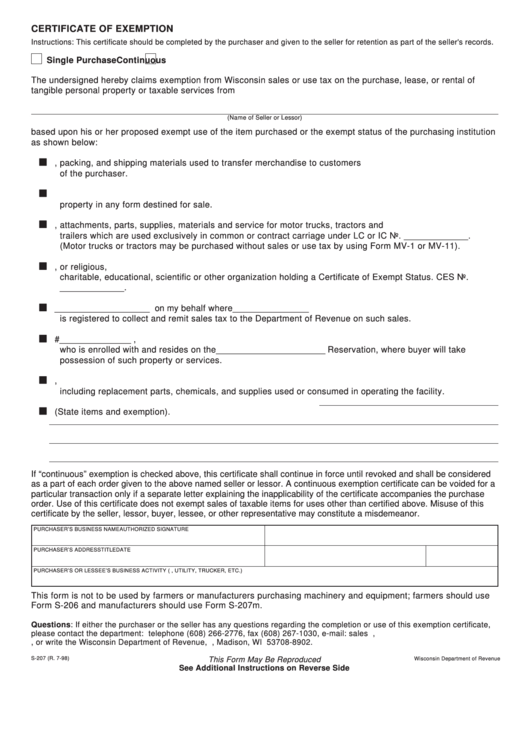

CERTIFICATE OF EXEMPTION

Instructions: This certificate should be completed by the purchaser and given to the seller for retention as part of the seller's records.

Single Purchase

Continuous

The undersigned hereby claims exemption from Wisconsin sales or use tax on the purchase, lease, or rental of

tangible personal property or taxable services from

(Name of Seller or Lessor)

based upon his or her proposed exempt use of the item purchased or the exempt status of the purchasing institution

as shown below:

1. Containers and other packaging, packing, and shipping materials used to transfer merchandise to customers

of the purchaser.

2. Tangible personal property becoming an ingredient or component part of an article of tangible personal

property in any form destined for sale.

3. Trailers and accessories, attachments, parts, supplies, materials and service for motor trucks, tractors and

trailers which are used exclusively in common or contract carriage under LC or IC No. _____________.

(Motor trucks or tractors may be purchased without sales or use tax by using Form MV-1 or MV-11).

4. Items or services purchased directly by and used by a federal Wisconsin governmental unit, or religious,

charitable, educational, scientific or other organization holding a Certificate of Exempt Status. CES No.

_____________.

5. Tangible personal property to be resold by ____________________ on my behalf where ________________

is registered to collect and remit sales tax to the Department of Revenue on such sales.

6. Tangible personal property or services purchased by a Native American with enrollment # _______________ ,

who is enrolled with and resides on the _______________________ Reservation, where buyer will take

possession of such property or services.

7. Tangible personal property becoming a component of an industrial or municipal waste treatment facility,

including replacement parts, chemicals, and supplies used or consumed in operating the facility.

8. Other purchases exempted by law. (State items and exemption).

If “continuous” exemption is checked above, this certificate shall continue in force until revoked and shall be considered

as a part of each order given to the above named seller or lessor. A continuous exemption certificate can be voided for a

particular transaction only if a separate letter explaining the inapplicability of the certificate accompanies the purchase

order. Use of this certificate does not exempt sales of taxable items for uses other than certified above. Misuse of this

certificate by the seller, lessor, buyer, lessee, or other representative may constitute a misdemeanor.

PURCHASER’S BUSINESS NAME

AUTHORIZED SIGNATURE

PURCHASER’S ADDRESS

TITLE

DATE

PURCHASER’S OR LESSEE’S BUSINESS ACTIVITY (E.G. GROCER, UTILITY, TRUCKER, ETC.)

This form is not to be used by farmers or manufacturers purchasing machinery and equipment; farmers should use

Form S-206 and manufacturers should use Form S-207m.

Questions: If either the purchaser or the seller has any questions regarding the completion or use of this exemption certificate,

please contact the department: telephone (608) 266-2776, fax (608) 267-1030, e-mail: sales 10@mail.state.wi.us, http://

, or write the Wisconsin Department of Revenue, P.O. Box 8902, Madison, WI 53708-8902.

S-207 (R. 7-98)

This Form May Be Reproduced

Wisconsin Department of Revenue

See Additional Instructions on Reverse Side

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1