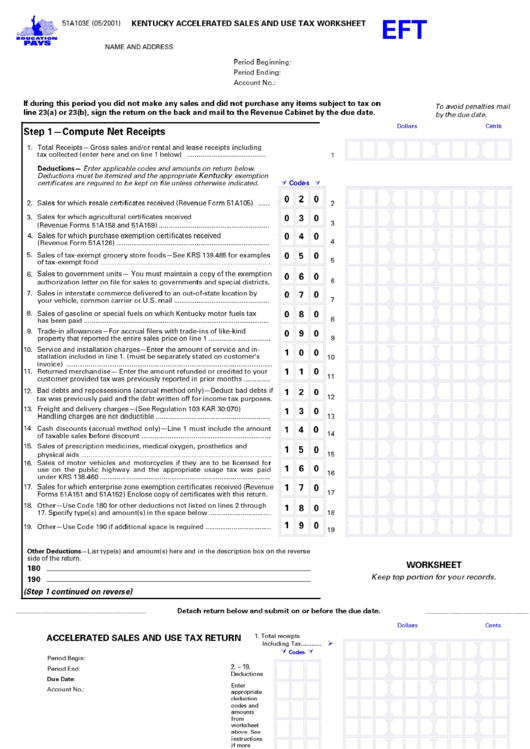

Form 51a103e - Kentucky Accelerated Sales And Use Tax Worksheet

ADVERTISEMENT

EFT

KENTUCKY ACCELERATED SALES AND USE TAX WORKSHEET

51A103E (05/2001)

NAME AND ADDRESS

Period Beginning:

Period Ending:

Account No.:

If during this period you did not make any sales and did not purchase any items subject to tax on

To avoid penalties mail

line 23(a) or 23(b), sign the return on the back and mail to the Revenue Cabinet by the due date.

by the due date.

AAAAAAAAAAAB

Dollars

Cents

Step 1ùCompute Net Receipts

CCEFCEFCEFCD

1. Total ReceiptsùGross sales and/or rental and lease receipts including

tax collected (enter here and on line 1 below) ..........................................

1

Deductionsù Enter applicable codes and amounts on return below.

Kentucky

AAAB

AAAAAAAAAAAB

Deductions must be itemized and the appropriate

exemption

certificates are required to be kept on file unless otherwise indicated.

Codes

CCCD

CCEFCEFCEFCD

0 2 0

2. Sales for which resale certificates received (Revenue Form 51A105) ......

2

CCCD

CCEFCEFCEFCD

0 3 0

Sales for which agricultural certificates received

3.

3

(Revenue Forms 51A158 and 51A159) ...........................................................

CCCD

CCEFCEFCEFCD

0 4 0

4.

Sales for which purchase exemption certificates received

4

(Revenue Form 51A126) ..................................................................................

CCCD

CCEFCEFCEFCD

0 5 0

5. Sales of tax-exempt grocery store foodsùSee KRS 139.485 for examples

5

of tax-exempt food ...........................................................................................

CCCD

CCEFCEFCEFCD

Sales to government unitsù You must maintain a copy of the exemption

0 6 0

6.

6

authorization letter on file for sales to governments and special districts.

CCCD

CCEFCEFCEFCD

0 7 0

7. Sales in interstate commerce delivered to an out-of-state location by

7

your vehicle, common carrier or U.S. mail ...................................................

CCCD

CCEFCEFCEFCD

0 8 0

8. Sales of gasoline or special fuels on which Kentucky motor fuels tax

8

has been paid ...................................................................................................

CCCD

CCEFCEFCEFCD

9. Trade-in allowancesùFor accrual filers with trade-ins of like-kind

0 9 0

property that reported the entire sales price on line 1 .................................

9

CCCD

CCEFCEFCEFCD

10. Service and installation chargesùEnter the amount of service and in-

1 0 0

stallation included in line 1. (must be separately stated on customerÆs

10

invoice) ..............................................................................................................

CCCD

CCEFCEFCEFCD

1 1 0

11. Returned merchandiseù Enter the amount refunded or credited to your

11

customer provided tax was previously reported in prior months ..............

CCCD

CCEFCEFCEFCD

1 2 0

Bad debts and repossessions (accrual method only)ùDeduct bad debts if

12.

12

tax was previously paid and the debt written off for income tax purposes.

CCCD

CCEFCEFCEFCD

13.

Freight and delivery chargesù(See Regulation 103 KAR 30:070)

1 3 0

Handling charges are not deductible .............................................................

13

CCCD

CCEFCEFCEFCD

1 4 0

14. Cash discounts (accrual method only)ùLine 1 must include the amount

14

of taxable sales before discount .....................................................................

CCCD

CCEFCEFCEFCD

15. Sales of prescription medicines, medical oxygen, prosthetics and

1 5 0

15

physical aids ......................................................................................................

Sales of motor vehicles and motorcycles if they are to be licensed for

16.

CCCD

CCEFCEFCEFCD

1 6 0

use on the public highway and the appropriate usage tax was paid

16

under KRS 138.460 ...........................................................................................

CCCD

CCEFCEFCEFCD

1 7 0

17.

Sales for which enterprise zone exemption certificates received (Revenue

17

Forms 51A151 and 51A152) Enclose copy of certificates with this return.

CCCD

CCEFCEFCEFCD

18. OtherùUse Code 180 for other deductions not listed on lines 2 through

1 8 0

17. Specify type(s) and amount(s) in the space below .................................

18

CCCD

CCEFCEFCEFCD

1 9 0

19. OtherùUse Code 190 if additional space is required ...................................

19

Other DeductionsùList type(s) and amount(s) here and in the description box on the reverse

side of the return.

WORKSHEET

180

Keep top portion for your records.

190

(Step 1 continued on reverse)

Detach return below and submit on or before the due date.

AAAAAAAAAAAB

Dollars

Cents

ACCELERATED SALES AND USE TAX RETURN

1. Total receipts

Including Tax............

CCEFCEFCEFCD

AAAB

Codes

Period Begin:

CCEFCEFCEFCD

CCCD

2. û 19.

Period End:

Deductions

Due Date:

CCEFCEFCEFCD

CCCD

Enter

Account No.:

appropriate

deduction

CCEFCEFCEFCD

CCCD

codes and

amounts

from

CCEFCEFCEFCD

CCCD

worksheet

above. See

instructions

CCEFCEFCEFCD

CCCD

if more

than 10

deduction

CCEFCEFCEFCD

CCCD

lines are

required.

CCEFCEFCEFCD

CCCD

CCEFCEFCEFCD

CCCD

51A103E9911

Kentucky Revenue Cabinet

Frankfort, KY 40620-0003

CCEFCEFCEFCD

CCCD

CCEFCEFCEFCD

CCCD

51A103E (05/2001)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2