Application For Exemption - Secretary Of State

ADVERTISEMENT

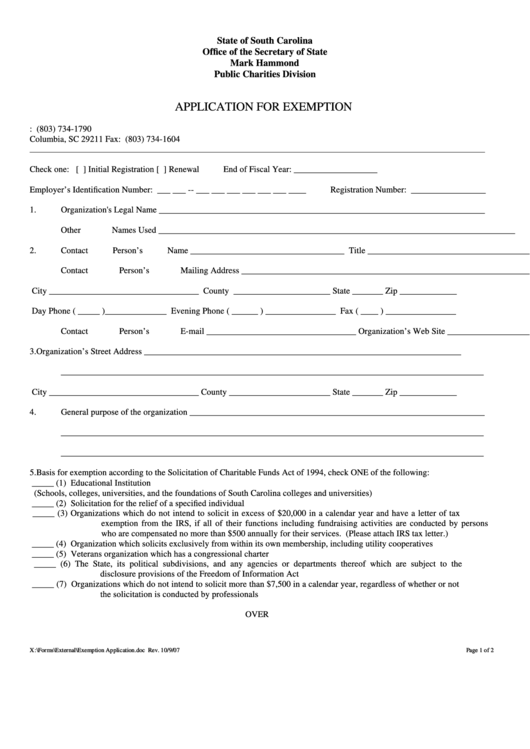

State of South Carolina

Office of the Secretary of State

Mark Hammond

Public Charities Division

APPLICATION FOR EXEMPTION

Post Office Box 11350

Phone: (803) 734-1790

charities@sos.sc.gov

Columbia, SC 29211

Fax: (803) 734-1604

Check one:

[ ] Initial Registration

[ ] Renewal

End of Fiscal Year: ___________________

Employer’s Identification Number: ___ ___ -- ___ ___ ___ ___ ___ ___ ____

Registration Number: _________________

1.

Organization's Legal Name __________________________________________________________________________

Other Names Used _________________________________________________________________________________

2.

Contact Person’s Name ___________________________________ Title _____________________________________

Contact Person’s Mailing Address ____________________________________________________________________

City __________________________________ County ______________________ State _______ Zip _____________

Day Phone ( _____ )______________ Evening Phone ( ______ ) ________________ Fax ( ____ ) ________________

Contact Person’s E-mail __________________________________ Organization’s Web Site ______________________

3.

Organization’s Street Address ________________________________________________________________________

________________________________________________________________________________________________

City __________________________________ County _______________________ State _______ Zip _____________

4.

General purpose of the organization ___________________________________________________________________

________________________________________________________________________________________________

________________________________________________________________________________________________

5.

Basis for exemption according to the Solicitation of Charitable Funds Act of 1994, check ONE of the following:

_____ (1) Educational Institution

(Schools, colleges, universities, and the foundations of South Carolina colleges and universities)

_____ (2) Solicitation for the relief of a specified individual

_____ (3) Organizations which do not intend to solicit in excess of $20,000 in a calendar year and have a letter of tax

exemption from the IRS, if all of their functions including fundraising activities are conducted by persons

who are compensated no more than $500 annually for their services. (Please attach IRS tax letter.)

_____ (4) Organization which solicits exclusively from within its own membership, including utility cooperatives

_____ (5) Veterans organization which has a congressional charter

_____ (6) The State, its political subdivisions, and any agencies or departments thereof which are subject to the

disclosure provisions of the Freedom of Information Act

_____ (7) Organizations which do not intend to solicit more than $7,500 in a calendar year, regardless of whether or not

the solicitation is conducted by professionals

OVER

X

:

\

F

o

r

m

s

\

E

x

t

e

r

n

a

l

\

E

x

e

m

p

t

i

o

n

A

p

p

l

i

c

a

t

i

o

n

.

d

o

c

R

e

v

.

1

0

/

9

/

0

7

P

a

g

e

1

o

f

2

X

:

\

F

o

r

m

s

\

E

x

t

e

r

n

a

l

\

E

x

e

m

p

t

i

o

n

A

p

p

l

i

c

a

t

i

o

n

.

d

o

c

R

e

v

.

1

0

/

9

/

0

7

P

a

g

e

1

o

f

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2