Form Ia 1041-V - Iowa Fiduciary Income Tax Payment Voucher - 1999

ADVERTISEMENT

I

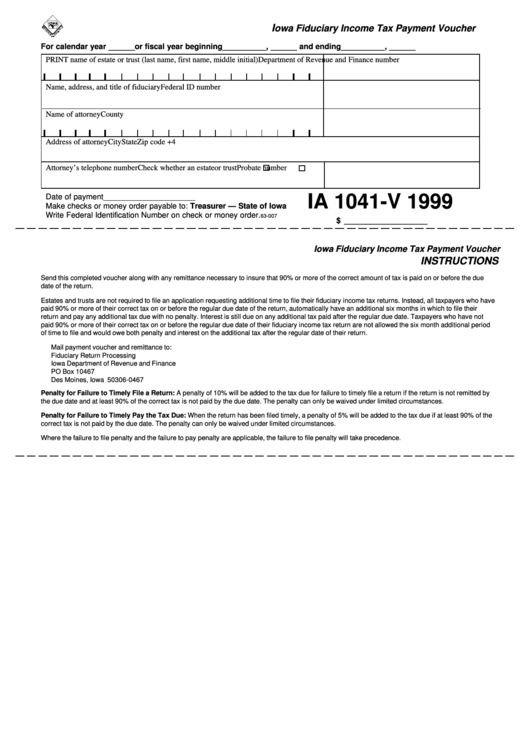

owa Fiduciary Income Tax Payment Voucher

For calendar year ______or fiscal year beginning __________ , ______ and ending __________ , ______

PRINT name of estate or trust (last name, first name, middle initial)

Department of Revenue and Finance number

Name, address, and title of fiduciary

Federal ID number

Name of attorney

County

Address of attorney

City

State

Zip code +4

Attorney’s telephone number

Check whether an estate

or trust

Probate number

Date of payment _____________________

IA 1041-V 1999

Make checks or money order payable to: Treasurer — State of Iowa

Write Federal Identification Number on check or money order.

63-007

$ ___________________

Iowa Fiduciary Income Tax Payment Voucher

INSTRUCTIONS

Send this completed voucher along with any remittance necessary to insure that 90% or more of the correct amount of tax is paid on or before the due

date of the return.

Estates and trusts are not required to file an application requesting additional time to file their fiduciary income tax returns. Instead, all taxpayers who have

paid 90% or more of their correct tax on or before the regular due date of the return, automatically have an additional six months in which to file their

return and pay any additional tax due with no penalty. Interest is still due on any additional tax paid after the regular due date. Taxpayers who have not

paid 90% or more of their correct tax on or before the regular due date of their fiduciary income tax return are not allowed the six month additional period

of time to file and would owe both penalty and interest on the additional tax after the regular date of their return.

Mail payment voucher and remittance to:

Fiduciary Return Processing

Iowa Department of Revenue and Finance

PO Box 10467

Des Moines, Iowa 50306-0467

Penalty for Failure to Timely File a Return: A penalty of 10% will be added to the tax due for failure to timely file a return if the return is not remitted by

the due date and at least 90% of the correct tax is not paid by the due date. The penalty can only be waived under limited circumstances.

Penalty for Failure to Timely Pay the Tax Due: When the return has been filed timely, a penalty of 5% will be added to the tax due if at least 90% of the

correct tax is not paid by the due date. The penalty can only be waived under limited circumstances.

Where the failure to file penalty and the failure to pay penalty are applicable, the failure to file penalty will take precedence.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2