Form Ptr-1a - Homeowners Verification Of 2012 And 2013 Property Taxes

ADVERTISEMENT

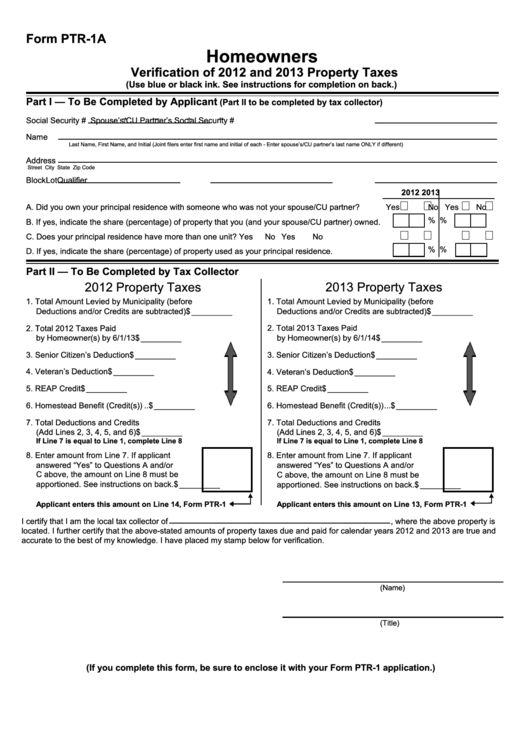

Form PTR-1A

Homeowners

Verification of 2012 and 2013 Property Taxes

(Use blue or black ink. See instructions for completion on back.)

Part I — To Be Completed by Applicant

(Part II to be completed by tax collector)

–

–

–

–

Social Security #

Spouse’s/CU Partner’s Social Security #

Name

Last Name, First Name, and Initial (Joint filers enter first name and initial of each - Enter spouse’s/CU partner’s last name ONLY if different)

Address

Street

City

State

Zip Code

Block

Lot

Qualifier

2012

2013

A. Did you own your principal residence with someone who was not your spouse/CU partner?

Yes

No

Yes

No

%

%

B. If yes, indicate the share (percentage) of property that you (and your spouse/CU partner) owned.

C. Does your principal residence have more than one unit?

Yes

No

Yes

No

%

%

D. If yes, indicate the share (percentage) of property used as your principal residence.

Part II — To Be Completed by Tax Collector

2012 Property Taxes

2013 Property Taxes

1. Total Amount Levied by Municipality (before

1. Total Amount Levied by Municipality (before

Deductions and/or Credits are subtracted) ....... $ _________

Deductions and/or Credits are subtracted) ....... $ _________

2. Total 2012 Taxes Paid

2. Total 2013 Taxes Paid

by Homeowner(s) by 6/1/13 ...... $ _________

by Homeowner(s) by 6/1/14 ...... $ _________

3. Senior Citizen’s Deduction ........ $ _________

3. Senior Citizen’s Deduction ........ $ _________

4. Veteran’s Deduction .................. $ _________

4. Veteran’s Deduction .................. $ _________

5. REAP Credit .............................. $ _________

5. REAP Credit .............................. $ _________

6. Homestead Benefit (Credit(s)) .. $ _________

6. Homestead Benefit (Credit(s)) ... $ _________

7. Total Deductions and Credits

7. Total Deductions and Credits

(Add Lines 2, 3, 4, 5, and 6) .............................. $ _________

(Add Lines 2, 3, 4, 5, and 6) .............................. $ _________

If Line 7 is equal to Line 1, complete Line 8

If Line 7 is equal to Line 1, complete Line 8

8. Enter amount from Line 7. If applicant

8. Enter amount from Line 7. If applicant

answered “Yes” to Questions A and/or

answered “Yes” to Questions A and/or

C above, the amount on Line 8 must be

C above, the amount on Line 8 must be

apportioned. See instructions on back. ............. $ _________

apportioned. See instructions on back. ............. $ _________

Applicant enters this amount on Line 14, Form PTR-1

Applicant enters this amount on Line 13, Form PTR-1

I certify that I am the local tax collector of

, where the above property is

located. I further certify that the above-stated amounts of property taxes due and paid for calendar years 2012 and 2013 are true and

accurate to the best of my knowledge. I have placed my stamp below for verification.

(Name)

(Title)

(If you complete this form, be sure to enclose it with your Form PTR-1 application.)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1