Claim Form And Instructions - Office Of The State Treasurer John D. Perdue, State Treasurer

ADVERTISEMENT

Zip

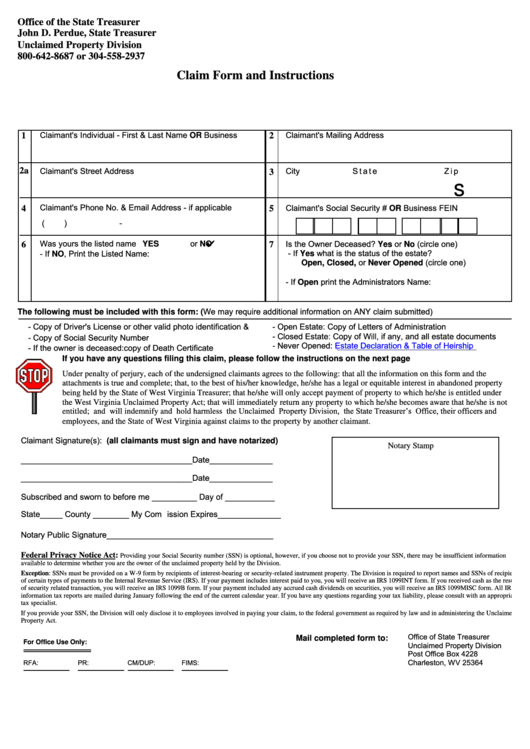

Office of the State Treasurer

John D. Perdue, State Treasurer

Unclaimed Property Division

800-642-8687 or 304-558-2937

Claim Form and Instructions

Claimant's Mailing Address

Claimant's Individual - First & Last Name OR Business

1

2

Claimant's Street Address

City

State

Zip

2a

3

Claimant's Phone No. & Email Address - if applicable

Claimant's Social Security # OR Business FEIN

4

5

(

)

-

Was yours the listed name YES

or NO

Is the Owner Deceased? Yes or No (circle one)

6

7

- If Yes what is the status of the estate?

- If NO, Print the Listed Name:

Open, Closed, or Never Opened (circle one)

- If Open print the Administrators Name:

The following must be included with this form: (We may require additional information on ANY claim submitted)

- Copy of Driver's License or other valid photo identification &

- Open Estate: Copy of Letters of Administration

- Closed Estate: Copy of Will, if any, and all estate documents

- Copy of Social Security Number

- Never Opened:

Estate Declaration & Table of Heirship

- If the owner is deceased:copy of Death Certificate

If you have any questions filing this claim, please follow the instructions on the next page

Under penalty of perjury, each of the undersigned claimants agrees to the following: that all the information on this form and the

attachments is true and complete; that, to the best of his/her knowledge, he/she has a legal or equitable interest in abandoned property

being held by the State of West Virginia Treasurer; that he/she will only accept payment of property to which he/she is entitled under

the West Virginia Unclaimed Property Act; that will immediately return any property to which he/she becomes aware that he/she is not

entitled; and will indemnify and hold harmless the Unclaimed Property Division, the State Treasurer’s Office, their officers and

employees, and the State of West Virginia against claims to the property by another claimant.

Claimant Signature(s): (all claimants must sign and have notarized)

Notary Stamp

______________________________________Date______________

______________________________________Date______________

Subscribed and sworn to before me __________ Day of ___________

State_____ County ________ My Com ission Expires______________

Notary Public Signature_____________________________________

Federal Privacy Notice Act:

Providing your Social Security number (SSN) is optional, however, if you choose not to provide your SSN, there may be insufficient information

available to determine whether you are the owner of the unclaimed property held by the Division.

Exception: SSNs must be provided on a W-9 form by recipients of interest-bearing or security-related instrument property. The Division is required to report names and SSNs of recipients

of certain types of payments to the Internal Revenue Service (IRS). If your payment includes interest paid to you, you will receive an IRS 1099INT form. If you received cash as the result

of security related transaction, you will receive an IRS 1099B form. If your payment included any accrued cash dividends on securities, you will receive an IRS 1099MISC form. All IRS

information tax reports are mailed during January following the end of the current calendar year. If you have any questions regarding your tax liability, please consult with an appropriate

tax specialist.

If you provide your SSN, the Division will only disclose it to employees involved in paying your claim, to the federal government as required by law and in administering the Unclaimed

Property Act.

Office of State Treasurer

Mail completed form to:

For Office Use Only:

Unclaimed Property Division

Post Office Box 4228

Charleston, WV 25364

RFA:

PR:

CM/DUP:

FIMS:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1