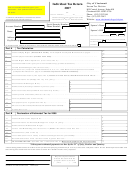

Individual Tax Return - City Of Blue Ash - 2007 Page 2

ADVERTISEMENT

WORKSHEET A - SALARIES, WAGES, TIPS, AND OTHER COMPENSATION

(To be completed by taxpayers who receive W-2 income from more than one source.)

*****Attach copies of all W-2s used to compute your local income*****

Other City Tax Withheld

Employer

City Where Employed

Qualifying Wages

Blue Ash Tax Withheld

Up to 1.25% of Wages Taxed

Totals

$

$

$

(Enter Total Qualifying Wages on Line 1, Page 1)

WORKSHEET B - BUSINESS INCOME or LOSS

**Attach copies of all Federal Forms and Schedules used to compute your local income. **

Column A

Column B

Blue Ash Taxable

Income / (Loss)

Blue Ash Percentage

Schedules

Income

from Federal

(Column A x Column B)

Schedules

Schedule C - Business Income

(From Step 5 of

Schedule Y)

1.

$

$

(A separate allocation schedule is required for each

%

Schedule C).

Schedule E - Rental Income

2.

$

$

Residents enter profit/loss from all properties. Nonresidents

100 %

enter only profit/loss from Blue Ash properties.

Schedule K-1 - Partnership Income

3.

$

$

(Residents enter profit/loss from entities that do not

100 %

withhold Blue Ash tax on entire distributive share)

(From Step 5 of

Miscellaneous Income –

1099-MISC, W-2G,

4.

$

Schedule Y)

$

Schedule F, etc.

%

Net Operating Loss Carryforward

5.

$

(

Attach worksheet and enter as a (loss))

Total Income (Loss)

6.

$

(Combine Lines 1 through 5 and enter this amount on Page 1, Line 6)

SCHEDULE Y - BUSINESS APPORTIONMENT FORMULA

(To be completed by all nonresidents who earn a portion of their net profits in Blue Ash.)

a. Located

b. Located in

c. Percentage (b / a)

Everywhere

Blue Ash

STEP 1.

Average Original Cost of Real and Tangible Personal Property..

Gross Annual Rent Paid Multiplied by 8…………………………

%

TOTAL STEP 1……………………..……………………………..

$

$

%

STEP 2.

Wages, Salaries, and Other Compensation Paid…………….

$

$

Gross Receipts from Sales Made and/or Work or Services

STEP 3.

%

Performed…………………………………………………………

$

$

%

STEP 4.

Total Percentages. (Add Percentages from Steps 1-3)………

%

STEP 5.

Apportionment Percentage (Divide Total Percentage by Number of Percentages Used)………………………....……

TO PAY BY CREDIT CARD:

Enter number and expiration date fully and accurately.

No.

No.

EXP. DATE:

/

/

PHONE NUMBER:

(H)

(W)

CARDHOLDER SIGNATURE:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2