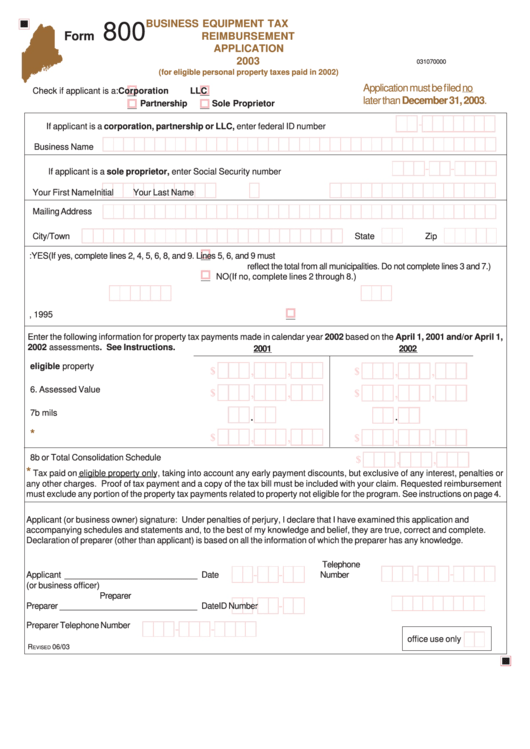

Form 800 - Business Equipment Tax Reimbursement Application - 2003

ADVERTISEMENT

BUSINESS EQUIPMENT TAX

*031070000*

800

Form

REIMBURSEMENT

APPLICATION

2003

031070000

(for eligible personal property taxes paid in 2002)

Application must be filed no

Check if applicant is a:

Corporation

LLC

later than December 31, 2003.

Partnership

Sole Proprietor

-

If applicant is a corporation, partnership or LLC, enter federal ID number ........................

Business Name

-

-

If applicant is a sole proprietor, enter Social Security number ............................................

Your First Name

Initial

Your Last Name

Mailing Address

City/Town

State

Zip

1. Consolidated application:

YES

(If yes, complete lines 2, 4, 5, 6, 8, and 9. Lines 5, 6, and 9 must

reflect the total from all municipalities. Do not complete lines 3 and 7.)

NO

(If no, complete lines 2 through 8.)

2. Business Code

3. Municipal Code

4. Check this box if business was started on or after April 1, 1995

Enter the following information for property tax payments made in calendar year 2002 based on the April 1, 2001 and/or April 1,

2002 assessments. See Instructions.

2001

2002

5. Original cost of eligible property ......... 5a

5b

$

$

,

,

,

,

6.

Assessed Value .................................. 6a

6b

$

$

,

,

,

,

7. Property Tax Rate ................................ 7a mils

7b mils

.

.

*

$

$

8. Requested Reimbursement

................ 8a

,

,

8b

,

,

$

9. Total Reimbursement. Line 8a plus line 8b or Total Consolidation Schedule ..... 9

,

,

*

Tax paid on eligible property only, taking into account any early payment discounts, but exclusive of any interest, penalties or

any other charges. Proof of tax payment and a copy of the tax bill must be included with your claim. Requested reimbursement

must exclude any portion of the property tax payments related to property not eligible for the program. See instructions on page 4.

Applicant (or business owner) signature: Under penalties of perjury, I declare that I have examined this application and

accompanying schedules and statements and, to the best of my knowledge and belief, they are true, correct and complete.

Declaration of preparer (other than applicant) is based on all the information of which the preparer has any knowledge.

Telephone

-

-

-

-

Applicant ____________________________ Date

Number

(or business officer)

Preparer

-

-

Preparer _____________________________ Date

ID Number

Preparer Telephone Number

-

-

office use only

R

06/03

EVISED

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2