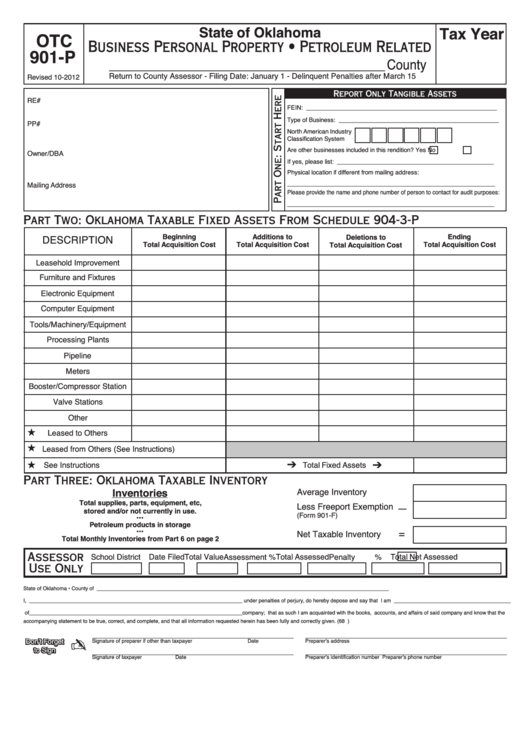

Form Otc 901-P - Business Personal Property - Petroleum Related

ADVERTISEMENT

State of Oklahoma

Tax Year

OTC

Business Personal Property • Petroleum Related

901-P

____________________________________County

Return to County Assessor - Filing Date: January 1 - Delinquent Penalties after March 15

Revised 10-2012

Report Only Tangible Assets

RE#

FEIN: ________________________________________________________

Type of Business: _______________________________________________

PP#

North American Industry

Classification System

Are other businesses included in this rendition?

Yes

No

Owner/DBA

If yes, please list: ______________________________________________

Physical location if different from mailing address:

_____________________________________________________________

Mailing Address

Please provide the name and phone number of person to contact for audit purposes:

________________________________________________________________

Part Two: Oklahoma Taxable Fixed Assets From Schedule 904-3-P

Beginning

Additions to

Ending

DESCRIPTION

Deletions to

Total Acquisition Cost

Total Acquisition Cost

Total Acquisition Cost

Total Acquisition Cost

Leasehold Improvement

Furniture and Fixtures

Electronic Equipment

Computer Equipment

Tools/Machinery/Equipment

Processing Plants

Pipeline

Meters

Booster/Compressor Station

Valve Stations

Other

★

Leased to Others

★

Leased from Others (See Instructions)

See Instructions

Total Fixed Assets

★

➔

➔

Part Three: Oklahoma Taxable Inventory

Inventories

Average Inventory

Total supplies, parts, equipment, etc,

Less Freeport Exemption

—

stored and/or not currently in use.

(Form 901-F)

•••

Petroleum products in storage

=

•••

Net Taxable Inventory

Total Monthly Inventories from Part 6 on page 2

Assessor

School District

Date Filed

Total Value

Assessment %

Total Assessed

Penalty

% Total Net Assessed

Use Only

State of Oklahoma • County of ____________________________________________________________________________________________________

I, _________________________________________________________________________ under penalties of perjury, do hereby depose and say that I am ________________________________________

of _________________________________________________________________________ company; that as such I am acquainted with the books, accounts, and affairs of said company and know that the

accompanying statement to be true, correct, and complete, and that all information requested herein has been fully and correctly given. (68 O.S. Section 2945 provides penalties for false oaths)

✍

Don’t Forget

Signature of preparer if other than taxpayer

Date

Preparer’s address

to Sign

Signature of taxpayer

Date

Preparer’s identification number

Preparer’s phone number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2