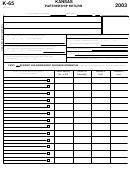

Form K-65 - Kansas Partnership Return - 2003 Page 2

ADVERTISEMENT

PART II

MODIFICATIONS TO COMPUTE KANSAS ADJUSTED GROSS INCOME OF PARTNERS

9. Total state and municipal interest not specifically exempt from Kansas tax . . . . . . . . . . . . . .

9

10. Taxes on or measured by income or fees or payments in lieu of income taxes . . . . . . . . . . .

10

11. Other additions to federal ordinary income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

12

12. Interest on obligations of the United States . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

13. Other subtractions from federal ordinary income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

14. Partnership adjustment from other partnerships . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

15. Fiduciary adjustments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

PART III

APPORTIONMENT OF INCOME

This schedule is to be used only by partnerships that derive income or have activities both within and without Kansas.

16. Apportionment fraction:

PERCENT

WITHIN KANSAS

TOTAL COMPANY

a. Average cost of real and tangible personal property owned or

WITHIN KANSAS

rented at the beginning and end of year. (Exclude property not

connected with the business and construction in progress, see

16a

%

instructions.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16b

%

b. Payroll . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

16c

c. Gross sales or revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

17

17. Total percent (Add lines 16a, 16b, & 16c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

%

18. Average percent (Divide line 17 by the number of factors utilized) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

I declare under the penalties of perjury that to the best of my knowledge this is a true, correct, and complete return.

sign

Signature of partner or member

Date

here

Signature of preparer other than partner or member

Address

Date

TELEPHONE NUMBER: ____________________________ The number you furnish will be confidential and should be one at which you can be reached during

our office hours. If you prefer that the department contact your tax preparer in regard to questions about this form, please provide the name and number at

which your tax preparer may be reached during our office hours: _____________________________________

ENCLOSE A COPY OF YOUR FEDERAL RETURN, PAGES 1, 2, 3 AND 4 TO THIS RETURN. PLEASE DO NOT ATTACH SCHEDULE K-1 TO

THE RETURN WHEN FILED. THE DEPARTMENT RESERVES THE RIGHT TO REQUEST ADDITIONAL INFORMATION AS NECESSARY.

MAIL THIS RETURN TO: KANSAS INCOME TAX, KANSAS DEPARTMENT OF REVENUE, 915 SW HARRISON ST., TOPEKA, KANSAS 66699-7000

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2