Form K-75 - Historic Site Contribution Credit - Kansas

ADVERTISEMENT

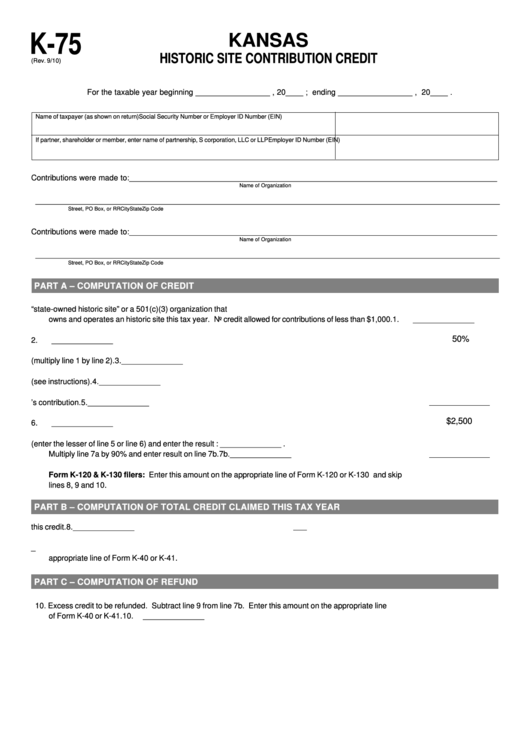

K-75

KANSAS

HISTORIC SITE CONTRIBUTION CREDIT

(Rev. 9/10)

For the taxable year beginning _________________ , 20____ ; ending _________________ , 20____ .

Name of taxpayer (as shown on return)

Social Security Number or Employer ID Number (EIN)

If partner, shareholder or member, enter name of partnership, S corporation, LLC or LLP

Employer ID Number (EIN)

Contributions were made to: ____________________________________________________________________________________

Name of Organization

__________________________________________________________________________________________________________

Street, PO Box, or RR

City

State

Zip Code

Contributions were made to: ____________________________________________________________________________________

Name of Organization

__________________________________________________________________________________________________________

Street, PO Box, or RR

City

State

Zip Code

PART A – COMPUTATION OF CREDIT

1. Total amount of cash/property contributed to a “state-owned historic site” or a 501(c)(3) organization that

owns and operates an historic site this tax year. No credit allowed for contributions of less than $1,000.

1.

______________

50%

2. Maximum percentage allowed.

2.

______________

3. Allowable credit for this tax year (multiply line 1 by line 2).

3.

______________

4. Proportionate share percentage (see instructions).

4.

______________

5. Your share of the credit for this year’s contribution.

5.

______________

$2,500

6. Credit Limitation.

6.

______________

7a. Maximum credit allowed (enter the lesser of line 5 or line 6) and enter the result : ______________ .

Multiply line 7a by 90% and enter result on line 7b.

7b.

______________

Form K-120 & K-130 filers: Enter this amount on the appropriate line of Form K-120 or K-130 and skip

lines 8, 9 and 10.

PART B – COMPUTATION OF TOTAL CREDIT CLAIMED THIS TAX YEAR

8. Enter your total Kansas tax liability for this tax year to be applied against this credit.

8.

______________

9. Amount of credit allowable this tax year . Enter the lesser of line 7b or line 8. Enter this amount on the

9.

______________

appropriate line of Form K-40 or K-41.

PART C – COMPUTATION OF REFUND

10. Excess credit to be refunded. Subtract line 9 from line 7b. Enter this amount on the appropriate line

of Form K-40 or K-41.

10.

______________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1