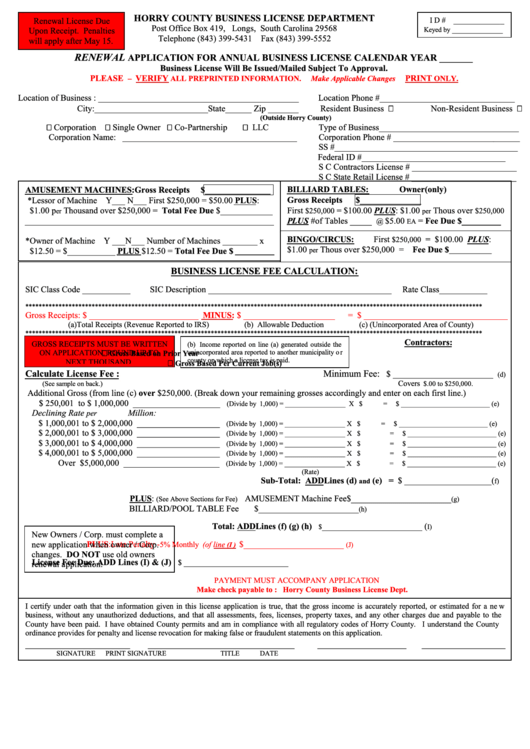

Renewal Application For Annual Business License Form - Horry County Business License Department

ADVERTISEMENT

HORRY COUNTY BUSINESS LICENSE DEPARTMENT

Renewal License Due

I D # _____________

Post Office Box 419, Longs, South Carolina 29568

_____________

Upon Receipt. Penalties

Keyed by

Telephone (843) 399-5431 Fax (843) 399-5552

will apply after May 15.

RENEWAL

APPLICATION FOR ANNUAL BUSINESS LICENSE CALENDAR YEAR _______

Business License Will Be Issued/Mailed Subject To Approval.

PLEASE

VERIFY

PRINT

–

ALL PREPRINTED INFORMATION.

Make Applicable Changes

ONLY.

Location of Business : ______________________________________________

Location Phone #_______________________________

City:__________________________State______ Zip _______

Resident Business

Non-Resident Business

(Outside Horry County)

Corporation

Single Owner

Co-Partnership

LLC

Type of Business________________________________

Corporation Name: ________________________________________

Corporation Phone # _____________________________

SS #__________________________________________

Federal ID #_________________________________

S C Contractors License # ________________________

S C State Retail License # ________________________

BILLIARD TABLES:

Owner (only)

AMUSEMENT MACHINES: Gross Receipts

$_______________

*Lessor of Machine Y___ N___ First $250,000 = $50.00 PLUS:

Gross Receipts

$______________

$1.00 p

Thousand over $250,000 = Total Fee Due $____________

First

= $100.00 PLUS: $1.00

Thous over

$250,000

$250,000

er

per

PLUS #of Tables _____

$5.00

= Fee Due $_________

@

EA

BINGO/CIRCUS:

First

= $100.00 PLUS:

$250,000

*Owner of Machine Y ___N___ Number of Machines ________ x

$1.00

Thous over $250,000 = Fee Due $

$12.50 = $___________ PLUS $12.50 = Total Fee Due $ _________

per

____________

BUSINESS LICENSE FEE CALCULATION:

SIC Class Code ___________

SIC Description __________________________________________

Rate Class___________

******************************************************************************************************************************************

Gross Receipts: $ _________________________ MINUS: $ _____________________

= $ _________________________________

(a)Total Receipts (Revenue Reported to IRS)

(b) Allowable Deduction

(c) (Unincorporated Area of County)

******************************************************************************************************************************************

Contractors:

GROSS RECEIPTS MUST BE WRITTEN

(b) Income reported on line (a) generated outside the

unincorporated area reported to another municipality or

ON APPLICATION. ROUND UP TO

Gross Based on Prior Year

county on which a license tax is paid.

NEXT THOUSAND

Gross Based Per Current Job(s)

Calculate License Fee :

Minimum Fee:

$ _______________________

(d)

Covers

(See sample on back.)

$.00 to $250,000.

Additional Gross (from line (c) over $250,000. (Break down your remaining grosses accordingly and enter on each first line.)

$ 250,001 to $ 1,000,000 ____________________

(Divide by 1,000) = _________________ X $

=

$ _________________________ (e)

Declining Rate

Million:

per

$ 1,000,001 to $ 2,000,000 ___________________

(Divide by 1,000) = _________________ X $

=

$ _________________________ (e)

$ 2,000,001 to $ 3,000,000 ___________________

(Divide by 1,000) = _________________ X $

=

$ _________________________ (e)

$ 3,000,001 to $ 4,000,000 ___________________

(Divide by 1,000) = _________________ X $

=

$ _________________________ (e)

$ 4,000,001 to $ 5,000,000 ___________________

(Divide by 1,000) = _________________ X $

=

$ _________________________ (e)

Over $5,000,000 ______________________

(Divide by 1,000) = _________________ X $

=

$ _________________________ (e)

(Rate)

Sub-Total: ADD Lines (d)

(e) = $ ____________________(

and

f)

PLUS:

AMUSEMENT Machine Fee

$_______________________

(See Above Sections for Fee)

(g)

BILLIARD/POOL TABLE Fee

$_______________________

(h)

Total: ADD Lines (f) (g) (h)

_______________________ (

$

I)

New Owners / Corp. must complete a

PLUS: Late Penalty -

$_______________________

new application when owner / Corp.

5% Monthly (of line

(I )

(J)

changes. DO NOT use old owners

License Fee Due: ADD Lines (I) & (J)

________________________

$

renewal application.

PAYMENT MUST ACCOMPANY APPLICATION

Make check payable to : Horry County Business License Dept.

I certify under oath that the information given in this license application is true, that the gross income is accurately reported, or estimated for a new

business, without any unauthorized deductions, and that all assessments, fees, licenses, property taxes, and any other charges due and payable to the

County have been paid. I have obtained County permits and am in compliance with all regulatory codes of Horry County. I understand the County

ordinance provides for penalty and license revocation for making false or fraudulent statements on this application.

____________________

____________________________

_________________

________________

SIGNATURE

PRINT SIGNATURE

TITLE

DATE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1