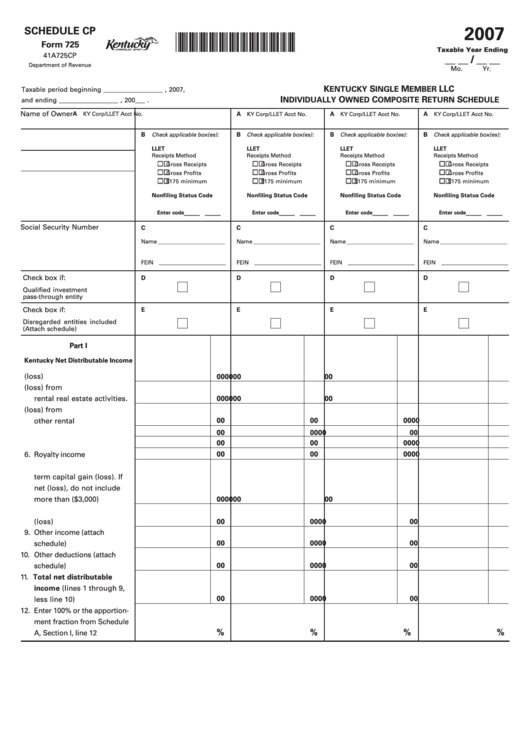

Form 725 - Schedule Cp - Kentucky Single Member Llc Individually Owned Composite Return Schedule - 2007

ADVERTISEMENT

SCHEDULE CP

2007

*0700020272*

Form 725

Taxable Year Ending

41A725CP

__ __ / __ __

Department of Revenue

Mo.

Yr.

K

S

M

LLC

ENTUCKY

INGLE

EMBER

Taxable period beginning __________________ , 2007,

I

O

C

R

S

NDIVIDUALLY

WNED

OMPOSITE

ETURN

CHEDULE

and ending __________________ , 200___ .

Name of Owner

A

KY Corp/LLET Acct No.

A

KY Corp/LLET Acct No.

A

KY Corp/LLET Acct No.

A

KY Corp/LLET Acct No.

B

Check applicable box(es):

B

Check applicable box(es):

B

Check applicable box(es):

B

Check applicable box(es):

LLET

LLET

LLET

LLET

Receipts Method

Receipts Method

Receipts Method

Receipts Method

Gross Receipts

Gross Receipts

Gross Receipts

Gross Receipts

Gross Profits

Gross Profits

Gross Profits

Gross Profits

$175 minimum

$175 minimum

$175 minimum

$175 minimum

Nonfiling Status Code

Nonfiling Status Code

Nonfiling Status Code

Nonfiling Status Code

___ ___

___ ___

___ ___

___ ___

Enter code

Enter code

Enter code

Enter code

Social Security Number

C

C

C

C

Name ________________________

Name ________________________

Name ________________________

Name ________________________

FEIN

_________________________

FEIN

_________________________

FEIN

_________________________

FEIN

_________________________

Check box if:

D

D

D

D

Qualified investment

pass-through entity

Check box if:

E

E

E

E

Disregarded entities included

(Attach schedule)

Part I

Kentucky Net Distributable Income

1. Ordinary income (loss) .......

00

00

00

00

2. Net income (loss) from

00

00

00

00

rental real estate activities .

3. Net income (loss) from

00

00

00

00

other rental activities .........

4. Interest income ...................

00

00

00

00

5. Dividend income .................

00

00

00

00

6. Royalty income .....................

00

00

00

00

7. Net short-term and long-

term capital gain (loss). If

net (loss), do not include

more than ($3,000) .............

00

00

00

00

8. Section 1231 net gain or

(loss) ....................................

00

00

00

00

9. Other income (attach

00

00

00

00

schedule) ..............................

10. Other deductions (attach

00

00

00

00

schedule) ...............................

11. Total net distributable

income (lines 1 through 9,

00

00

00

00

less line 10) ..........................

12. Enter 100% or the apportion-

ment fraction from Schedule

%

%

%

%

A, Section I, line 12 ...............

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2