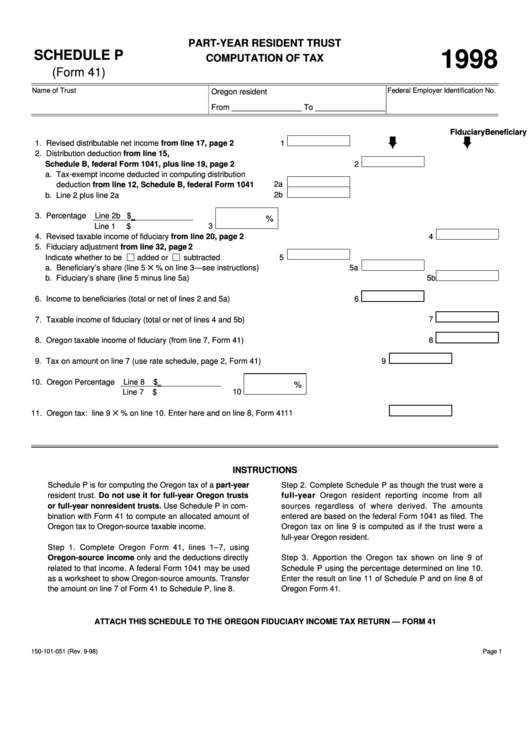

PART-YEAR RESIDENT TRUST

1998

SCHEDULE P

COMPUTATION OF TAX

(Form 41)

Name of Trust

Federal Employer Identification No.

Oregon resident

From ________________ To ________________

Beneficiary

Fiduciary

1. Revised distributable net income from line 17, page 2

...................

1

2. Distribution deduction from line 15,

Schedule B, federal Form 1041, plus line 19, page 2

.....................................................

2

a. Tax-exempt income deducted in computing distribution

2a

deduction from line 12, Schedule B, federal Form 1041

........

2b

b. Line 2 plus line 2a

....................................................................

3. Percentage

Line 2b $

%

=

Line 1

$

3

4. Revised taxable income of fiduciary from line 20, page 2

....................................................................................

4

5. Fiduciary adjustment from line 32, page 2

Indicate whether to be

added or

subtracted

..........................

5

........................................

5a

a. Beneficiary’s share (line 5

% on line 3—see instructions)

b. Fiduciary’s share (line 5 minus line 5a)

.............................................................................................................

5b

6. Income to beneficiaries (total or net of lines 2 and 5a)

.......................................................

6

7. Taxable income of fiduciary (total or net of lines 4 and 5b)

...................................................................................

7

....................................................................................

8. Oregon taxable income of fiduciary (from line 7, Form 41)

8

9. Tax on amount on line 7 (use rate schedule, page 2, Form 41)

......................................................

9

10. Oregon Percentage

Line 8

$

%

=

10

Line 7

$

11. Oregon tax: line 9

% on line 10. Enter here and on line 8, Form 41

............................................11

INSTRUCTIONS

Schedule P is for computing the Oregon tax of a part-year

Step 2. Complete Schedule P as though the trust were a

resident trust. Do not use it for full-year Oregon trusts

full-year Oregon resident reporting income from all

or full-year nonresident trusts. Use Schedule P in com-

sources regardless of where derived. The amounts

bination with Form 41 to compute an allocated amount of

entered are based on the federal Form 1041 as filed. The

Oregon tax to Oregon-source taxable income.

Oregon tax on line 9 is computed as if the trust were a

full-year Oregon resident.

Step 1. Complete Oregon Form 41, lines 1–7, using

Oregon-source income only and the deductions directly

Step 3. Apportion the Oregon tax shown on line 9 of

related to that income. A federal Form 1041 may be used

Schedule P using the percentage determined on line 10.

as a worksheet to show Oregon-source amounts. Transfer

Enter the result on line 11 of Schedule P and on line 8 of

the amount on line 7 of Form 41 to Schedule P, line 8.

Oregon Form 41.

ATTACH THIS SCHEDULE TO THE OREGON FIDUCIARY INCOME TAX RETURN — FORM 41

150-101-051 (Rev. 9-98)

Page 1

1

1 2

2