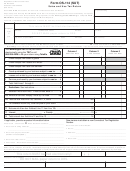

Form T-204r-Annual - Sales And Use Tax Return - Annual Reconciliation 2015 Page 2

ADVERTISEMENT

State of Rhode Island and Providence Plantations

Form T-204R-Annual - 2015

Sales and Use Tax Return - Annual Reconciliation

JAN - JUNE

JULY - DEC

TOTALS

1

a

Pet services..................................................................

1a

b

Residential dwelling/room rentals................................ 1b

c

Transportation services (taxi, limo, bus, ground)

1c

d

Clothing........................................................................

1d

e

Prewritten computer software delivered electronically

1e

or by “load and leave”..................................................

f

Over-the-counter (OTC) drugs and medicines.............

1f

g

Other sales: All sales not listed on lines 1a through 1f

1g

h

Gross sales. Add lines 1a through 1g.....................

1h

2

USE: Cost of personal property per RIGL 44-18-20....

2

3

TOTAL . Add lines 1h and 2........................................

3

4

a

Food and food ingredients for human consumption.....

4a

b

Resale...........................................................................

4b

c

Interstate.......................................................................

4c

d

Clothing and footwear for general use ($250 or less)...

4d

e

Sales of motor vehicles................................................

4e

f

Boats.............................................................................

4f

g

Prescription drugs.........................................................

4g

1. Federal and State.............................

4h1

Exempt

h

Organizations

2. Other exempt organizations &

4h2

non-profits RIGL 44-18-30(5)............

i

Heating fuels, electricity and gases..............................

4i

j

Manufacturing (equipment and supplies).....................

4j

k

Airplanes and airplane parts.........................................

4k

Residential dwelling/room rentals (greater than 30

l

4l

consecutive days or 1 calendar month)........................

m

Other (Deductions not separately listed above):

4m

Specify____________________________________ .

Total Deductions. Add lines 4a through 4m.........

4n

n

5

Net Taxable Sales. Subtract line 4n from line 3. Carry to page 1, line A.....................

5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2