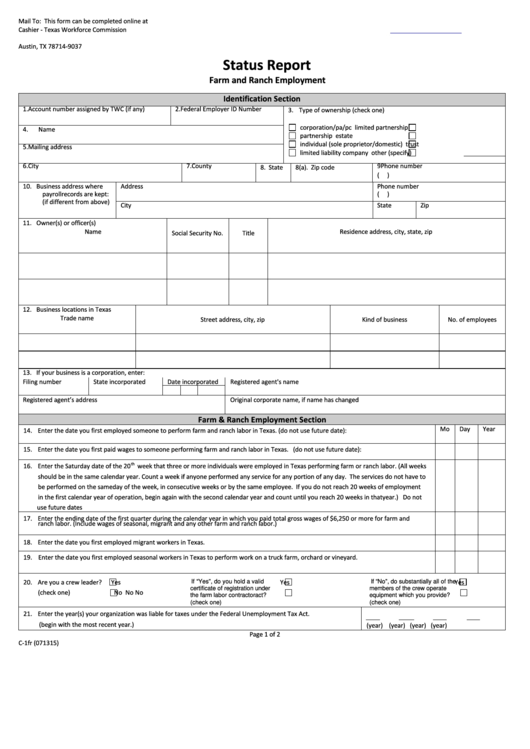

Mail To:

This form can be completed online at

Cashier - Texas Workforce Commission

P.O. Box 149037

Austin, TX 78714-9037

Status Report

Farm and Ranch Employment

Identification Section

1.

Account number assigned by TWC (if any)

2.

Federal Employer ID Number

3. Type of ownership (check one)

corporation/pa/pc

limited partnership

4.

Name

partnership

estate

individual (sole proprietor/domestic)

trust

5.

Mailing address

limited liability company

other (specify)

6.

City

7.

County

8. State

8(a). Zip code

9

Phone number

(

)

10. Business address where

Address

Phone number

payroll records are kept:

(

)

(if different from above)

City

State

Zip

11. Owner(s) or officer(s)

Name

Residence address, city, state, zip

Social Security No.

Title

12. Business locations in Texas

Trade name

Street address, city, zip

Kind of business

No. of employees

13. If your business is a corporation, enter:

Filing number

State incorporated

Date incorporated

Registered agent's name

Registered agent’s address

Original corporate name, if name has changed

Farm & Ranch Employment Section

Mo

Day

Year

14. Enter the date you first employed someone to perform farm and ranch labor in Texas. (do not use future date):

15. Enter the date you first paid wages to someone performing farm and ranch labor in Texas. (do not use future date):

th

16. Enter the Saturday date of the 20

week that three or more individuals were employed in Texas performing farm or ranch labor. (All weeks

should be in the same calendar year. Count a week if anyone performed any service for any portion of any day. The services do not have to

be performed on the same day of the week, in consecutive weeks or by the same employee. If you do not reach 20 weeks of employment

in the first calendar year of operation, begin again with the second calendar year and count until you reach 20 weeks in that year.) Do not

use future dates

17. Enter the ending date of the first quarter during the calendar year in which you paid total gross wages of $6,250 or more for farm and

ranch labor. (Include wages of seasonal, migrant and any other farm and ranch labor.)

18. Enter the date you first employed migrant workers in Texas.

19. Enter the date you first employed seasonal workers in Texas to perform work on a truck farm, orchard or vineyard.

20. Are you a crew leader?

Yes

Yes

Yes

If “Yes”, do you hold a valid

If “No”, do substantially all of the

certificate of registration under

members of the crew operate

(check one)

No

No

No

the farm labor contractor act?

equipment which you provide?

(check one)

(check one)

21. Enter the year(s) your organization was liable for taxes under the Federal Unemployment Tax Act.

(begin with the most recent year.)

(year)

(year)

(year)

(year)

Page 1 of 2

C-1fr (071315)

1

1 2

2